Menu

Menu

All Building insurance policies require you to state the sum to be insured for the total rebuilding cost of your property. This differs from your market value of a property that has no bearing on an Insurance rebuild value.

Our RICS Chartered Surveyors are well-versed in producing VAR (Value At Risk) surveys to indicate the more realistic sums to be insured.

This can be re-sold as a product by you. As the policyholder, It is your responsibility to obtain the correct rebuilding cost for your property, but always the broker's fault in their eyes when it is inadequately insured!

Understanding Value at Risk Surveys

A Value at Risk survey is a comprehensive assessment designed to gauge the potential risk associated with a business, individual, or asset. These surveys typically encompass various factors, from fixed and variable costs to production volume and the number of units produced. Given normal market conditions, a VaR survey quantifies the maximum loss you could feasibly encounter within a set timeframe.

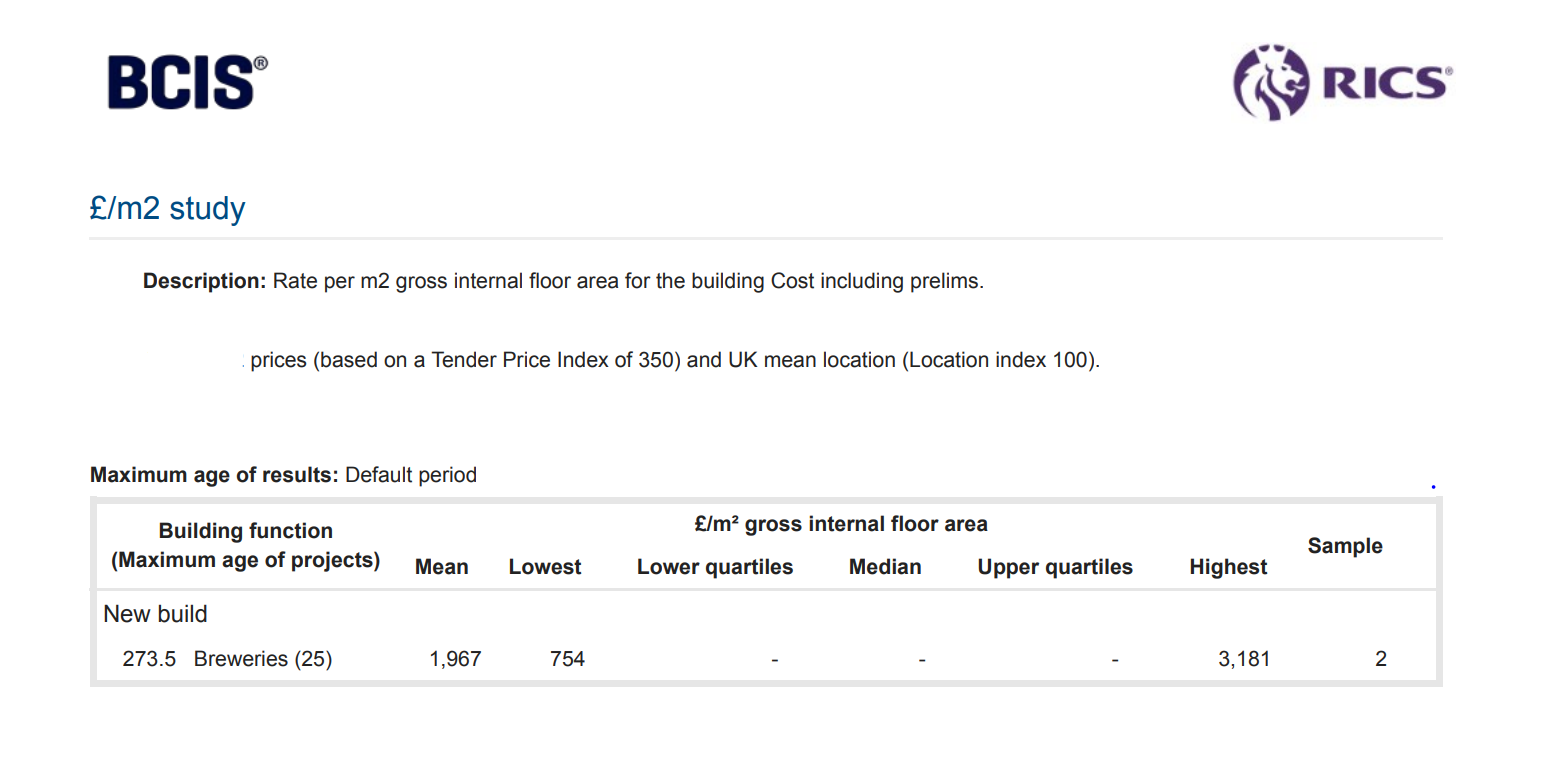

Asking a policyholder to estimate the cost of demolition and rebuilding the property to modern building regulations is usually beyond their understanding. Remember that no two properties are the same, and the total rebuilding costs for every type of building will be different and will vary depending on individual specifications. Calculations can be complex; correct rebuild costs usually equate to more premium as most people undervalue this aspect. Impact of VaR Surveys on Your Insurance Policy

So, how exactly does a VaR survey affect your insurance policy? Here are a few key ways:

Premium Determination: Insurance premiums hinge primarily on the perceived level of risk tied to the insured entity. A higher VaR could indicate a more significant risk, resulting in higher premiums.

Policy Terms: The VaR survey results can influence your policy's specific terms. Insurers may stipulate different conditions or coverage limits based on the risk assessment.

Claim Settlement: The VaR figure could come into play when settling claims. Insurers might consider the assessed risk when determining the amount payable under the policy.

VaR Surveys and Business Operations

If you're a business owner, understanding the intricacies of a VaR survey can help streamline your business activities. For instance, you can use the insights from the survey to manage and mitigate risks more effectively. By doing so, you could reduce your total variable cost and increase your number of sales.

Recognising the types of variable costs – like the cost of raw materials, credit card fees, or the cost of production – that influence your VaR can also aid in optimising your production process. This information can help you make adjustments to increase efficiency and reduce costs without compromising output quality.

Concluding Thoughts

Value at Risk surveys are robust, offering in-depth insight into potential risks and helping shape your insurance policy's terms. Understanding their implications could help you make more informed insurance coverage and business operations decisions.

So, when it comes to your insurance policy and the stability of your business, taking the time to understand and utilise VaR surveys could be one of the smartest moves you make. It’s not just about calculating variable costs or determining the number of units for production volume but about gaining a comprehensive understanding of risk, so you can protect your business now and in the future.

ABOUT

ABOUTFencing & Boundary Walls

Drives

Landscaping

Heating Systems

Hot & cold water

Gas

Electricity

Lighting

Sanitation

Drainage

Bathrooms

Foundations

Walls

Roofs

Floors

Partitions

Doors and windows

Finishes

Decorations

Fitted wardrobes

Kitchens

Swimming Pools

Garages

Outbuildings & Sheds

Ventilation

If you have been declined whilst trying to claim on your domestic or commercial insurance, we can help. We can also help with professional services, for example, Brokers, VAR Valuations and Managing Agents.