Imagine coming home one day to find your house engulfed in flames due to a faulty appliance you trusted. The relief of knowing your insurance will cover the damages is immense, but what about the underlying cause? Who holds the faulty manufacturer accountable?

This is where subrogation is a critical yet often overlooked process that ensures justice and financial recovery in the insurance world. In the face of rising incidents, like the startling 60 house fires per week in the UK caused by defective appliances, understanding subrogation’s role is more important than ever.

Dive into the mechanics of this essential insurance principle and discover why it’s a cornerstone of fairness and accountability in our modern world. This jargon-busting blog aims to explain subrogation in insurance claims and its importance for insurance companies. We will also discuss a real-life example involving a faulty appliance causing a house fire and present a relevant statistic on insurance claims caused by faulty appliances in the UK.

Fast facts:

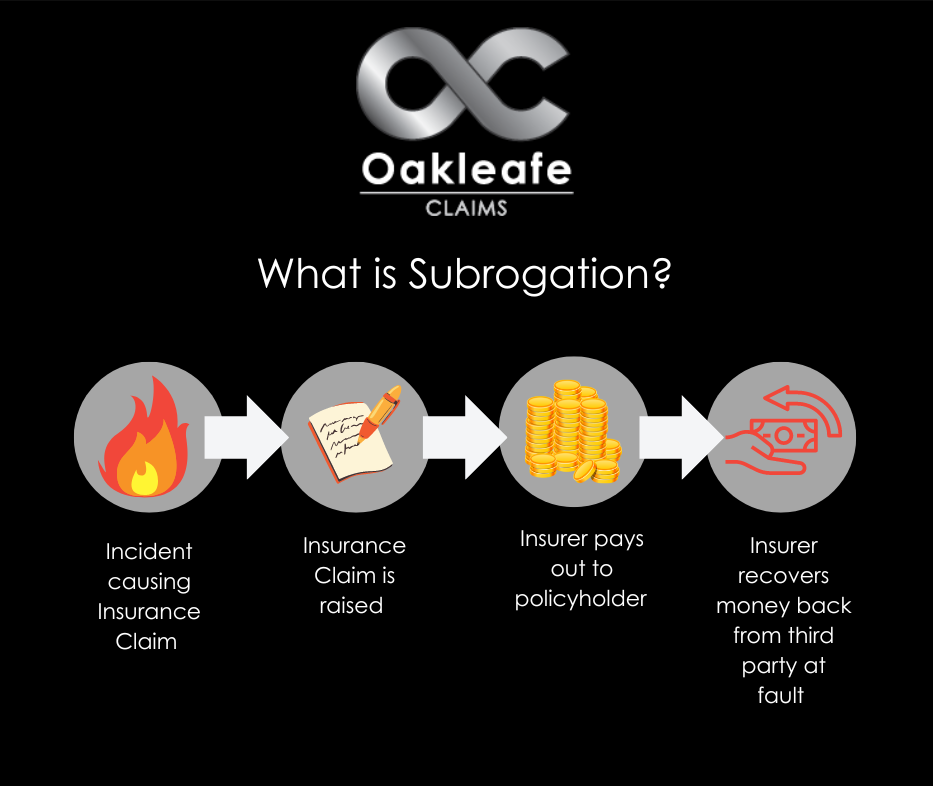

Subrogation is a legal principle that allows an insurance company to recover the money paid out to a policyholder from a third-party insurance policy that is responsible for the damages or loss. Essentially, the insurer “steps into the shoes” of the policyholder, files a claim and pursues compensation from the at-fault party. This process helps insurance companies recover their losses, lowering policyholders’ premiums.

Subrogation is often used when a third party is found to be at fault for causing the insured event. This can include a car accident, property damage, or a faulty product leading to a house fire insurance claim.

Example: Faulty Appliance Causing a House Fire Leading to Subrogation

Let’s consider an example where a homeowner’s insurance policy covers a house fire caused by a faulty appliance. In this scenario, the insurance company pays the homeowner’s claim for the damages caused by the fire. After an investigation, it was discovered that the appliance’s manufacturer was responsible for the fire due to a manufacturing defect leading to subrogation.

According to a study conducted by Electrical Safety First in the UK, nearly 60 house fires per week were caused by faulty appliances between 2019 and 2020. In such cases, subrogation allows the insurance company to recoup its money from the manufacturer after compensating the homeowner for their losses. The insurer may take legal action against the manufacturer to recover the money paid in the claim, holding the responsible party accountable.

What Oakleafe Clients Say:

Subrogation is essential for insurance companies for several reasons:

Subrogation is crucial to the insurance claim process, allowing insurers to recover their losses from at-fault parties. This legal principle is particularly important in cases involving faulty appliances causing house fires, ensuring manufacturers are held accountable for their actions. By understanding the concept of subrogation, you can better appreciate its importance in maintaining a fair and efficient insurance system.

Subrogation is more than just a technical term in the insurance industry; it’s a vital process that underpins the fairness and efficiency of managing insurance claims. By enabling insurers to recover costs from the responsible parties, subrogation ensures that the financial burden of losses falls squarely on those at fault, not on the innocent policyholders or the insurance companies.

This recovery mechanism helps maintain lower premiums and drives accountability and improved safety standards among manufacturers. Understanding this helps us appreciate its significant role in promoting justice and sustainability within the insurance system. So, the next time you hear about a house fire caused by a faulty appliance, remember that subrogation is the hidden force working to set things right.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial fire insurance claims, including riot claims, with thousands of satisfied policyholders who have received their deserved insurance settlement.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP