If your home or business has suffered serious damage, you’re already dealing with enough stress – the last thing you need is uncertainty when the loss adjuster shows up. Many policyholders feel unprepared or even intimidated by this part of the insurance claim process. And unfortunately, a single misstep can lead to reduced payouts or outright rejection.

This guide will give you clarity and confidence. Whether you’re facing flood, fire, theft, or another insured event, we’ll explain how to deal with a loss adjuster effectively — what they do, why insurers rely on them, and how you can protect your interests from the start. A fair outcome begins with being informed.

Learning how to deal with a loss adjuster before they arrive gives you a huge advantage.”

Who they are:

A loss adjuster is like a detective for the insurance company. They investigate what happened and determine the cost of fixing or replacing the items.

Why it matters:

If you’re not careful or don’t have proof, you might get less money than you should, or even nothing!

What to do before they visit:

During the visit:

After the visit:

What You Should Do Next:

A loss adjuster is a professional appointed by the insurance company to assess the validity and extent of your claim. Their primary job is to investigate the circumstances surrounding your claim, evaluate the damage or loss, and determine the amount the insurer should pay in settlement.

There are two primary types of adjusters you may encounter:

Understanding that the adjuster appointed by your insurer ultimately works in their best interests is essential. Approaching the assessment with preparation and knowledge can help protect your own interests during the process.

Insurance companies rely on loss adjusters to ensure that claims are managed with oversight and consistency. This benefits the insurer in several ways:

Adjusters investigate claims carefully to verify their validity and prevent fraudulent claims. For example, if a policyholder claims damage that existed before the insured incident or exaggerates the extent of loss, the adjuster will identify it.

Establishing an accurate cost for repair or replacement is vital. Loss adjusters utilise their expertise to assess the damage and ensure the insurer pays only the amount specified under the policy.

By scrutinising every aspect of a claim, adjusters help insurers control payout costs, ensuring policy terms and exclusions are adhered to.

While their work supports insurers, it can also lead to a fairer and more efficient claims process for policyholders when carried out professionally and ethically.

What Oakleafe Clients Say:

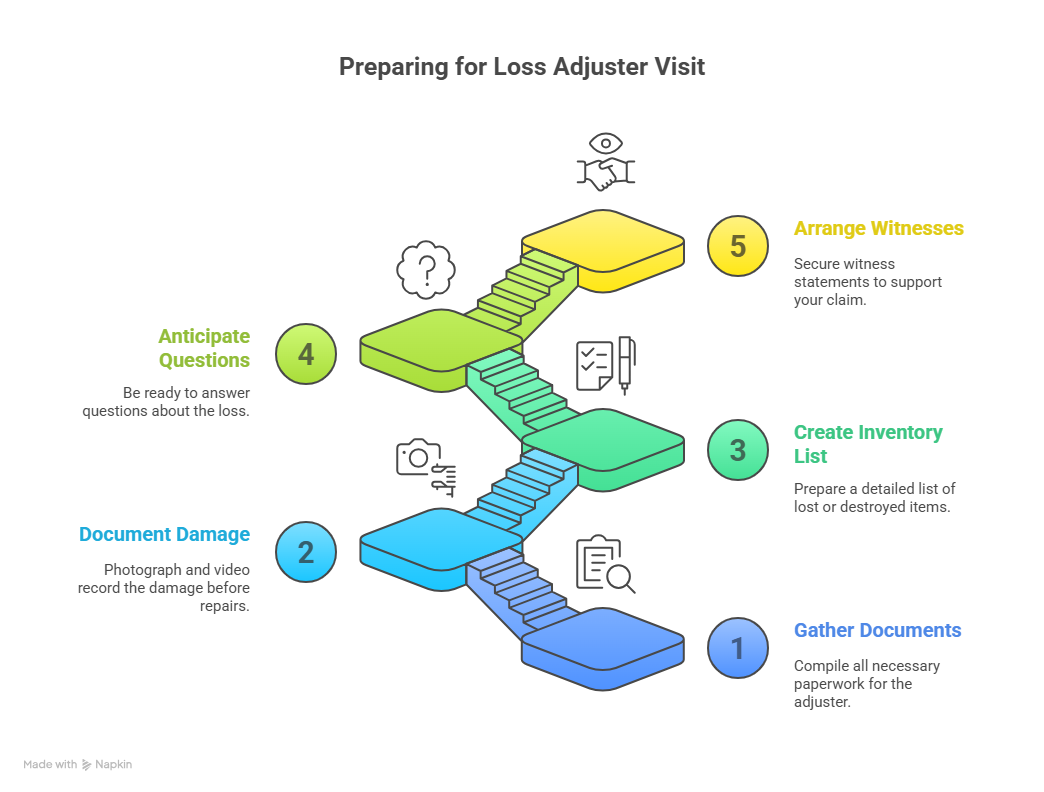

Preparing adequately for the loss adjuster’s visit is vital. If you’re unsure how to deal with a loss adjuster, the best place to start is with solid preparation. Presenting your claim clearly — and having the right evidence at hand — can make a big difference in how your settlement is handled. Follow these steps:

1. Gather All Relevant Documents

Compile all necessary paperwork before the adjuster arrives. This includes:

2. Document the Damage

Photograph and, if relevant, video record the damage before any repairs have been made. Include timestamps where possible and ensure your evidence is clear and comprehensive.

3. Create an Inventory List

If items have been lost or destroyed, prepare a list detailing their:

This will save time and reinforce the credibility of your claim.

4. Anticipate the Adjuster’s Questions

Be well-versed in the circumstances of the loss. For instance:

5. Arrange for Witnesses if Needed

If there are witnesses to the incident (e.g., neighbours or staff), ask them to provide statements or join the visit if necessary. Their accounts may strengthen your case.

During the visit, the loss adjuster will assess the scene and gather information to determine the validity and value of your claim. Here’s what to expect:

Common Questions They May Ask

Tip: Keep your responses consistent with any prior communications with your insurer.

What They’ll Inspect

Loss adjusters often employ specific negotiation techniques to minimise payouts. Being aware of potential tactics can help you respond confidently:

Adjusters may present initial figures that are significantly lower than your expected settlement. Politely seek clarification on how they calculated the value and provide evidence to justify your own estimate.

They may frame questions in ways designed to elicit admissions that could reduce liability. Stick to factual answers, and don’t speculate on what “might have” caused the damage or loss.

Adjusters may focus on exclusions buried in your policy’s small print. Review your policy ahead of time, and if you disagree with their interpretation, don’t hesitate to request further clarification or support documentation.

If you feel the settlement offered isn’t fair, express your counterpoints calmly and back them with evidence.

Once the visit is complete, the adjuster will prepare a report with their findings and recommendations for settlement. Here’s how to handle the next steps:

Review the Report Carefully

Request a copy of the adjuster’s findings and take the time to read through it thoroughly. Ensure all the facts and figures align with what was discussed during the visit.

Challenge Decisions if Needed

If you disagree with the settlement, you have options:

Escalate Disputes

If a suitable resolution isn’t reached, you may escalate your complaint:

Knowing how to deal with a loss adjuster is the key to success. It’s not about confrontation — it’s about being prepared, clear, and confident in your rights. The more organised and informed you are, the better your chances of securing a fair settlement.

Key takeaways:

Next steps:

Remember: the loss adjuster’s report can significantly influence your payout, but you have more control than you think. By taking proactive steps, you shift the odds back in your favour.

If you’re still unsure how to deal with a loss adjuster, get professional help.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP