When disaster strikes your business – whether it’s a burst pipe, a break-in, or a costly interruption – it’s not just property at stake. It’s your peace of mind, your team’s livelihood, and your bottom line. That’s why understanding business insurance claims isn’t just helpful – it’s essential. Unfortunately, many business owners only learn the process when they’re already knee-deep in crisis.

In this guide, we’ll walk you through exactly how business insurance claims work, the key steps to follow, and how to avoid common mistakes that can cost you time and money. Whether you’re facing property damage, a liability issue, or operational downtime, this article will help you feel more confident and in control of the claims process.

This quick summary gives you the essential points from the full article – ideal if you’re short on time or want to know what’s coming up.

What is a Business Insurance Claim?

Three Main Types of Claims:

Before You File a Claim:

How to Make a Claim:

What to Do in an Emergency:

If Your Claim Is Denied:

Key Things to Remember:

Business insurance claims are formal requests made by policyholders to their insurer, asking for compensation for losses or damages covered under their policy. These claims typically fall into three main categories:

Business insurance claims provide a way for businesses to secure the financial help they need to recover after loss or damage. They can mean the difference between bouncing back quickly and facing prolonged hardship.

Before calling your insurer to notify them, there are a few steps to take. Acting quickly and being organised can speed up the process and improve your likelihood of a successful outcome.

1. Review Your Policy

Take a careful look at your insurance policy and check whether your claim is covered. Look for the specific terms, coverage limits, exclusions, and the deductible you’re responsible for. This will save time and help manage expectations when speaking to the insurer.

2. Gather Evidence

Document the damage or loss thoroughly. Take clear photos and videos, locate receipts or invoices for damaged items, and prepare any other evidence that proves the value of your claim.

3. Prepare an Incident Report

Write a detailed description of what happened. Include relevant dates, times, supporting documents, and a list of everything affected. If applicable, include witness statements.

Being well-prepared sets the groundwork, making business insurance claims go smoother and reducing the back-and-forth with your insurer.

What Oakleafe Clients Say:

When you’re confident your claim is valid, here’s how to proceed:

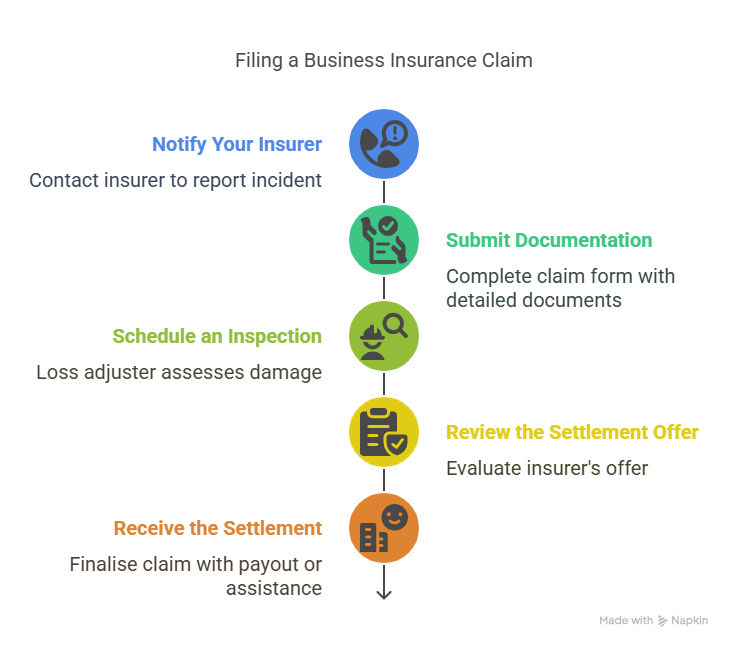

1. Notify Your Insurer

Contact your insurer as soon as possible to report the incident and begin the claims process. Most insurance companies have dedicated helplines or online claim submission portals. Be ready to provide your policy number and a description of the incident.

2. Submit Documentation

Complete the claim form provided by your insurer. Attach all relevant documents, such as proof of loss, photos, receipts, and your incident report. The more detailed and organised your submission, the quicker your claim can progress.

3. Schedule an Inspection

Your insurer may send a loss adjuster to assess the damage or investigate the circumstances of your claim. The adjuster works for the insurance company and aims to determine the extent of liability, so be honest and cooperative during the visit.

4. Review the Settlement Offer

Once the adjuster completes their assessment, the insurer will issue a settlement offer. Review this carefully to ensure it aligns with what you’re entitled to under your policy. If you need help, a loss assessor can represent your interests and negotiate on your behalf.

5. Receive the Settlement

If everything is approved, your insurer will process the payout or provide the necessary assistance for repairs. If there are any delays, contact your claims handler for updates.

In some situations, such as fires or floods, immediate action is required. Here’s what to do if you’re dealing with an urgent claim:

Most insurers have 24/7 hotlines for emergencies. Use them to report the incident and ask for specific instructions.

If damage is worsening or presents a safety risk, make temporary fixes to prevent further issues. For example, cover a broken window or stop a leak. Save receipts for these repairs, as they can usually be reimbursed under your claim.

Before fixing or removing anything permanently, ensure you have photographic and written evidence of the original damage. This will be crucial for your claim.

Occasionally, insurers may deny claims. Common reasons include filing for something not covered under your policy, missing documentation, or failing to follow the correct process.

If your claim is denied, don’t worry. You can take steps to appeal:

If disputes continue, you can escalate the matter to the Financial Ombudsman Service for impartial review.

What if my business operations are disrupted?

Business interruption insurance covers lost profits or additional expenses if you can’t operate due to a covered event. Ensure your policy includes this vital protection.

Will liability insurance cover an employee injury?

Employer liability insurance typically covers injuries sustained by employees while they are at work. However, public liability insurance only applies to non-employees, such as customers and visitors.

How long do claims take to be resolved?

Straightforward claims can be resolved in a few weeks, while complex cases may take several months. Promptly providing complete documentation helps minimise delays.

Can I use a broker to manage my claims process?

Yes, brokers can be invaluable during the claims process. They can liaise with insurers on your behalf, ensuring your claim is handled efficiently.

Business disruptions are hard enough – your insurance claim process shouldn’t make things worse. Acting quickly, understanding your policy inside out, and being organised from the start can make all the difference between a fast settlement and a drawn-out dispute.

And if insurance jargon, documentation, or back-and-forth negotiations feel overwhelming, you don’t have to face it alone. A qualified loss assessor or claims expert can take the weight off your shoulders and help you secure the settlement you deserve.

Key Takeaways

What to Do Next

If you’re unsure about your cover, facing delays, or your insurer has denied your claim, don’t leave money on the table. Oakleafe Claims is here to step in, represent your interests, and handle the process from start to finish.

Contact us today for a no-obligation consultation – and take the first step toward a fair, stress-free resolution.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement. With no upfront fees required, our internal data shows that insurance claims managed by professional loss assessors like Oakleafe can expect a settlement up to 40% higher than claims managed by the policyholder.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP