If your property has just been damaged – by fire, flood, or another disaster – you’re likely overwhelmed and unsure where to turn next.

The insurance claim process can feel like a maze of unfamiliar terms and procedures, and one of the most confusing roles in that process is the loss adjuster;

This article clears up that confusion. We’ll break down exactly what a loss adjuster is, how they operate, and why understanding their role can make a significant difference in the outcome of your claim.

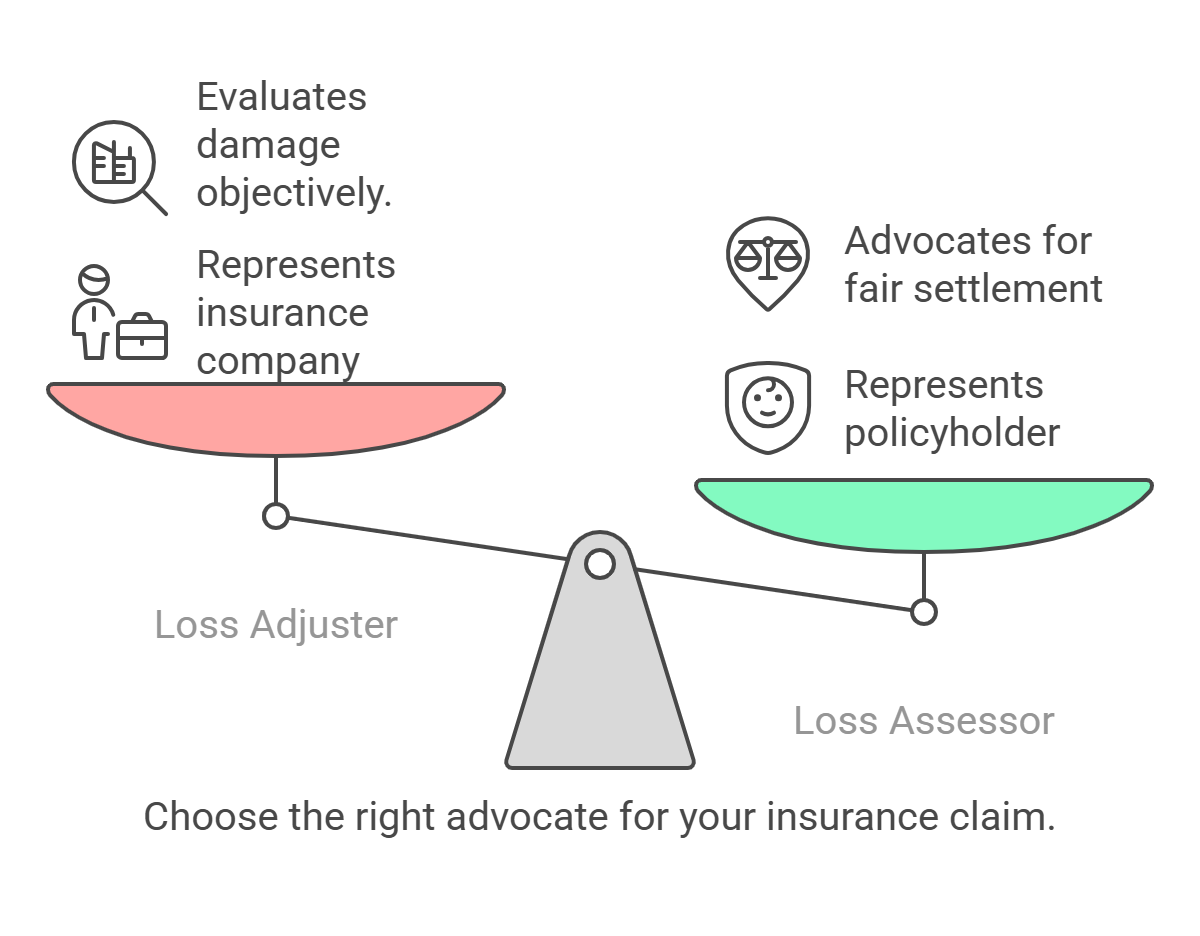

You’ll also learn the crucial difference between a loss adjuster and a loss assessor – especially important if you want someone truly fighting in your corner.

When your house experiences a disaster, such as a fire or flood, you might tell your insurance company so they can help pay to fix it. But before they give you money, they send a loss adjuster to check things out.

This person:

But here’s the important part: they work for the insurance company, not for you.

If you want someone to help you, that person is called a loss assessor. A loss assessor fights to make sure you get a fair amount of money from the insurance company.

A loss adjuster is a professional appointed to assess an insurance claim on behalf of an insurance company. Their primary job is to investigate the claim, verify its validity according to the policy, and recommend a fair settlement amount under the terms of the insurance agreement.

The loss adjuster serves as the insurance company’s expert evaluator. They aim to protect the insurer’s interests by ensuring that claims paid out align with the policy’s coverage.

Common Terms Related to Loss Adjusters:

What Oakleafe Clients Say:

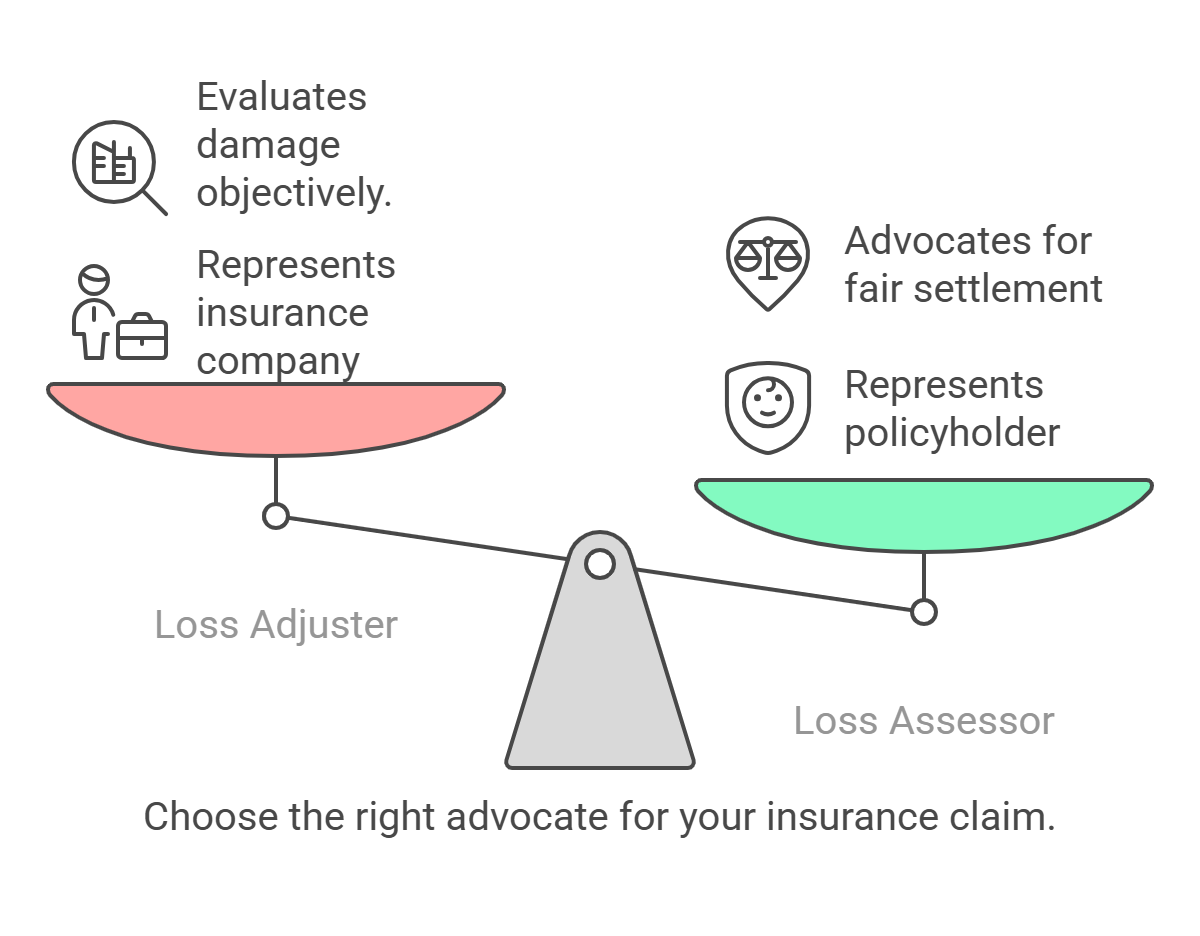

Loss adjusters carry out several key tasks throughout the claims process. Their responsibilities include:

Investigating the Claim

Loss adjusters begin by thoroughly reviewing the circumstances surrounding a claim. This may include interviewing those involved, gathering evidence, and reviewing the insurance policy to confirm coverage.

Conducting Site Inspections

For physical damage claims, such as fire or flood, loss adjusters will visit the site to inspect the damage first-hand. Their observations help them accurately estimate the cost of repairs or replacements.

Analysing Policy Terms

Each claim must align with the terms of the insurance policy. The loss adjuster ensures that the claim falls within coverage limits and checks for exclusions or special conditions.

Recommending a Settlement

Based on their findings, the adjuster calculates a recommended settlement amount. They consider repair costs, loss estimation, and the level of coverage provided by the policy.

Writing a Claim Report

The adjuster compiles their findings into a detailed report for the insurance company. This report outlines their investigations, calculations, and recommendations for how the insurer should proceed.

Insurance companies typically appoint loss adjusters. Their role is to protect the insurer’s financial interests, ensuring that payments made to policyholders are fair and aligned with the policy terms.

Sometimes, independent loss adjusters may be hired, particularly for complex claims. They still work for the insurer but are separate from its in-house claims team.

Key Points to Remember:

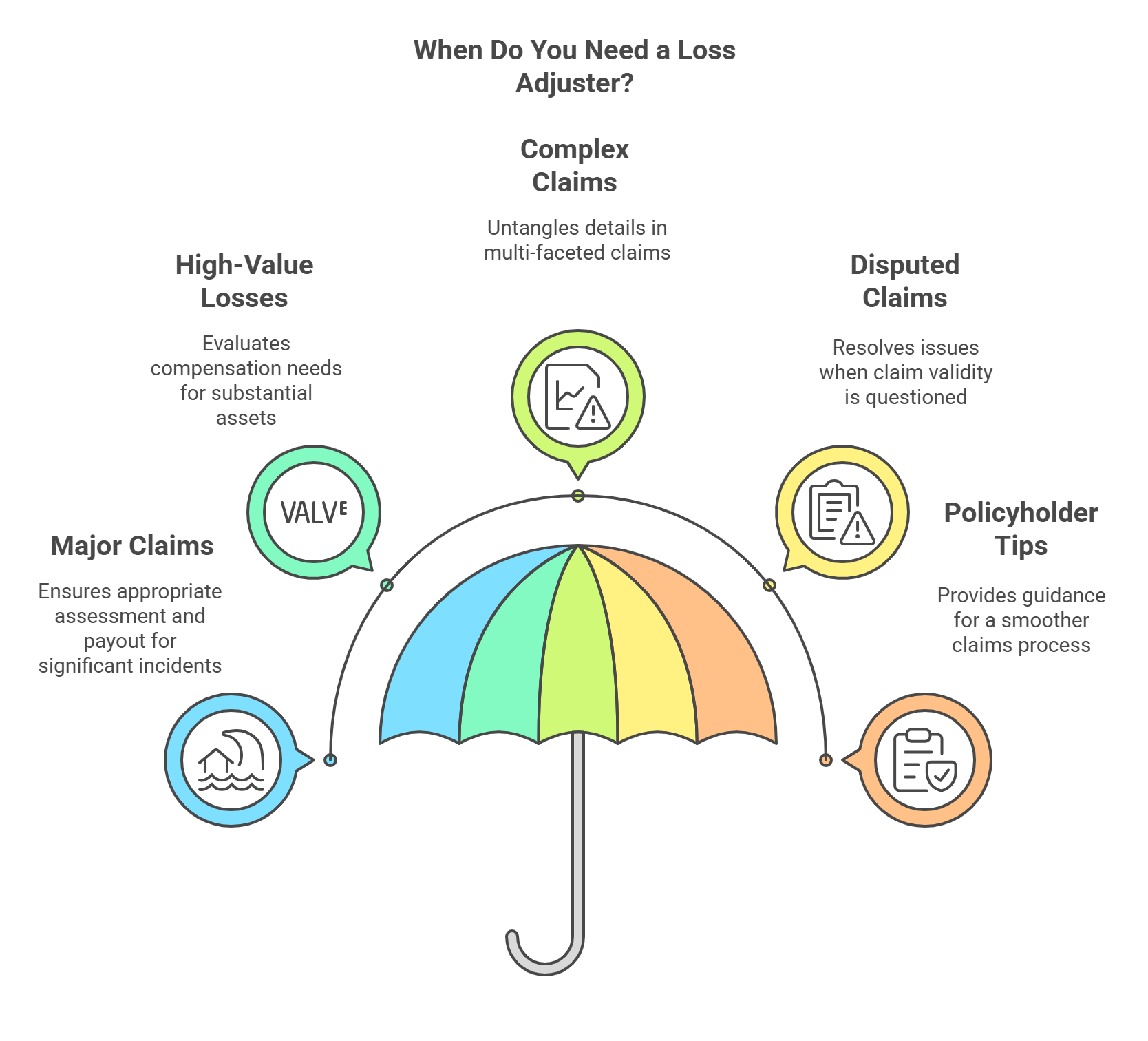

Many wonder about the difference between a loss adjuster and a loss assessor. Although the terms sound similar, they refer to professionals with very different allegiances.

Works For: The insurance company.

Role: To assess the claim on behalf of the insurer and ensure it complies with the policy.

Works For: You, the policyholder.

Role: To represent your interests during the claims process. This includes negotiating with the insurer and preparing the claim to maximise your payout.

Think of a loss adjuster as the insurer’s representative and a loss assessor as your advocate. If you feel your claim is particularly complex or are concerned about fairness, a loss assessor can provide invaluable support.

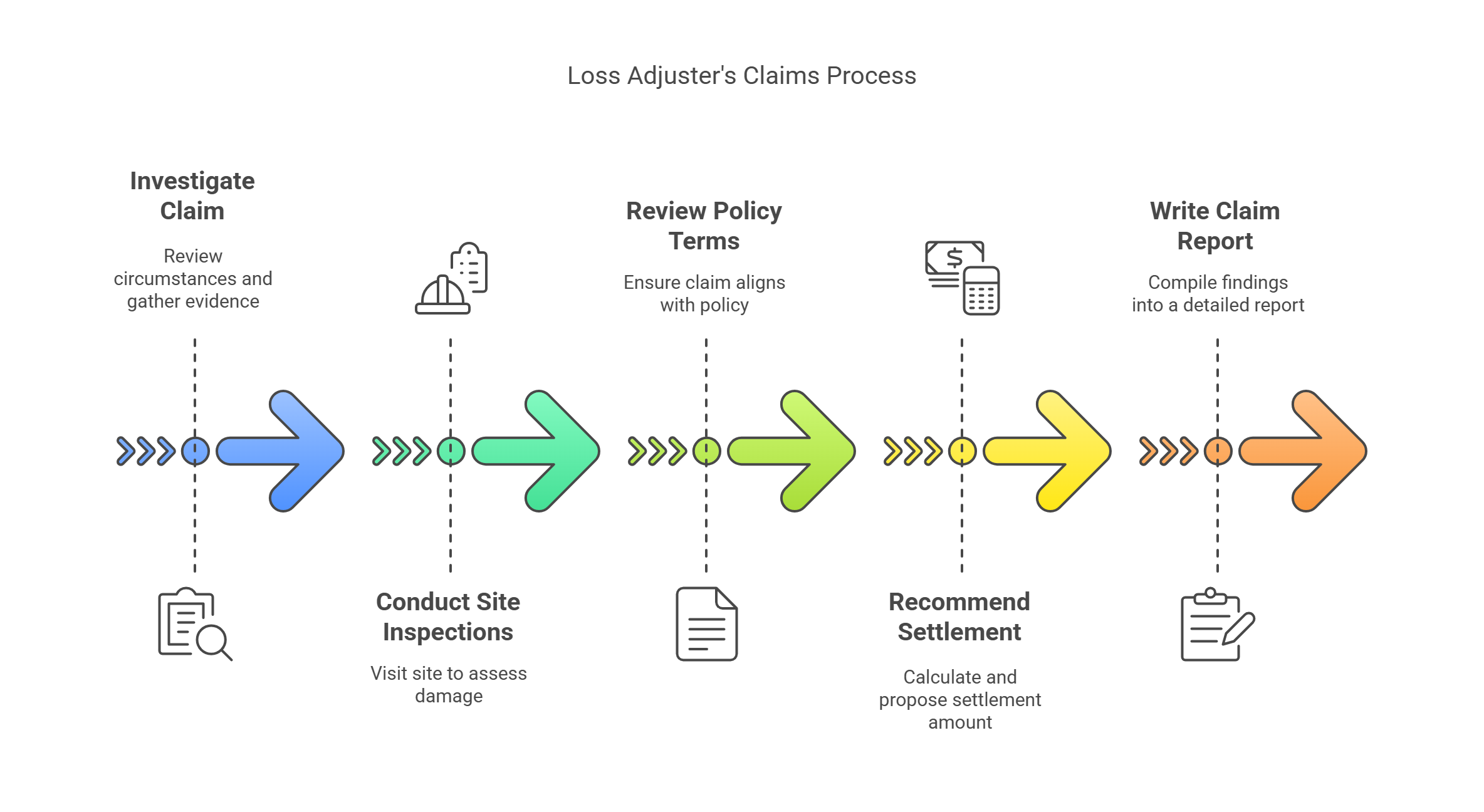

While your insurer will usually determine whether a loss adjuster is involved, there are specific situations where their expertise becomes essential.

These include:

While the loss adjuster’s role is to protect the insurer’s interests, policyholders can take steps to ensure a smoother claims process and better outcomes.

Tips for Working with a Loss Adjuster:

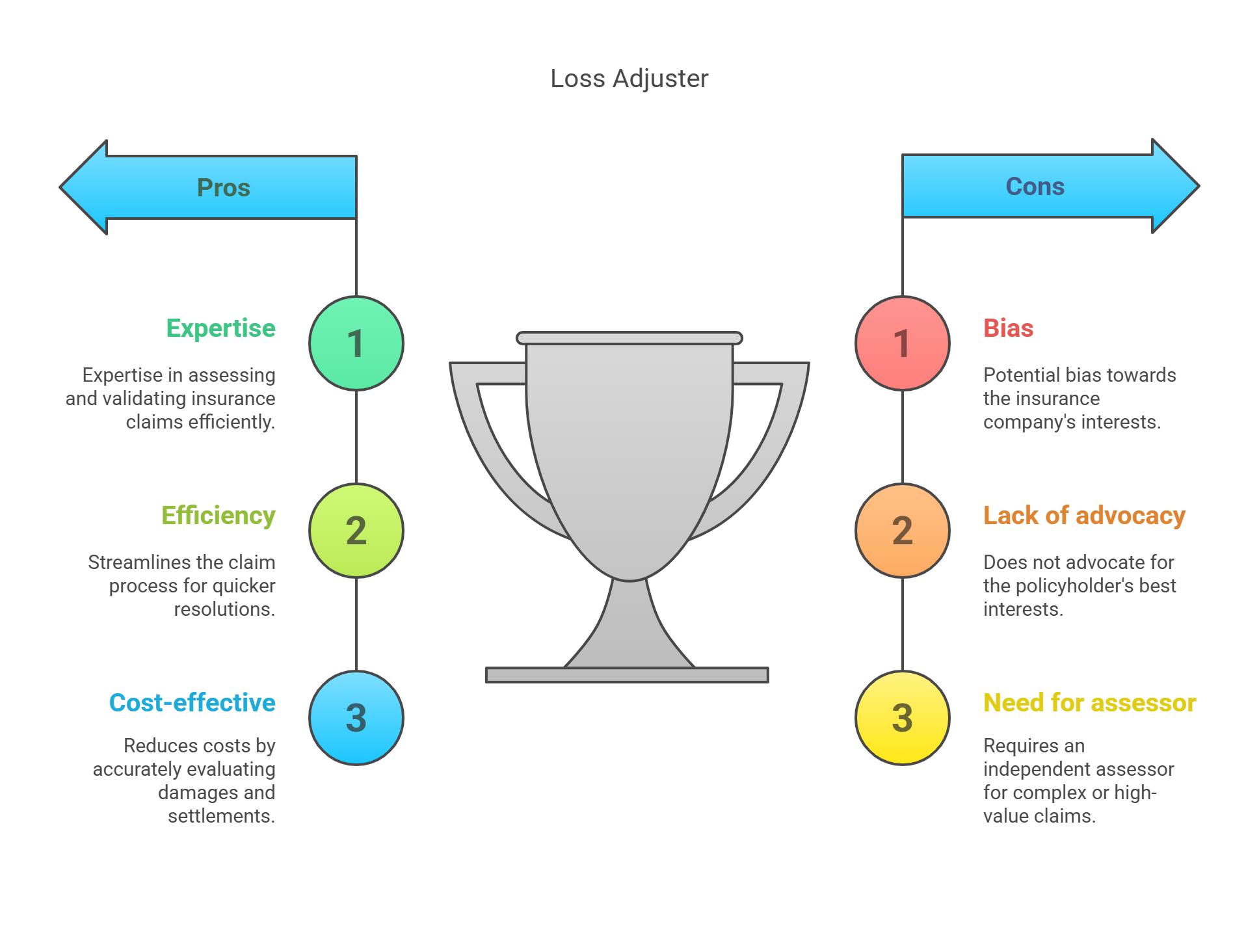

Loss adjusters play a pivotal role in the insurance claims process, acting as the bridge between insurers and policyholders. While they provide a professional service for the insurance company, policyholders need to stay informed about their rights, the limits of their insurance policy, and how adjusters operate.

Understanding what a loss adjuster does – and who they work for – is essential if you’re dealing with an insurance claim. While they may appear neutral, it’s important to remember they represent the insurer’s interests, not yours. Knowing how to prepare, what to expect, and when to seek professional help can significantly influence the fairness and speed of your settlement.

By arming yourself with this knowledge, you can approach your claim with clarity and confidence, knowing exactly where you stand.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP