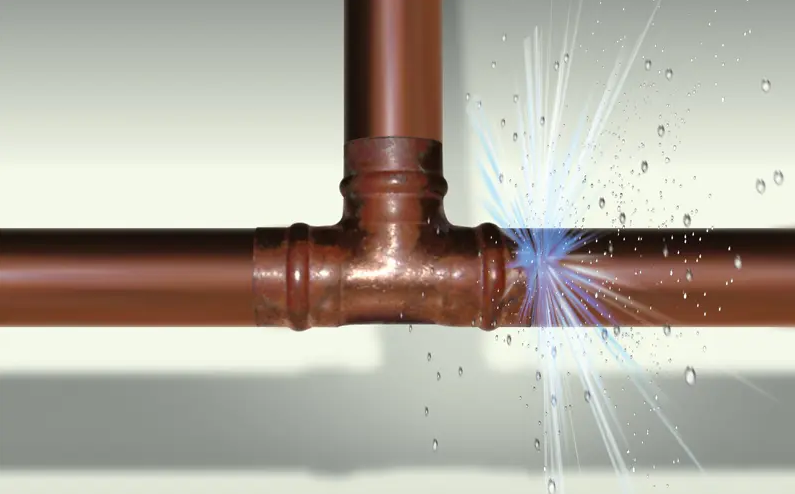

What Causes Pipes to Burst? – When the chilling frost of winter sets in, it’s not just our bodies that need protection from the cold. The water pipes that bring water into our homes can freeze, resulting in a potential burst pipe. Burst pipes are a common and often devastating issue faced by homeowners.

Whether it’s a sudden spike in water pressure, freezing temperatures, or gradual wear and tear, the reasons behind burst pipes can be numerous and complex. Dealing with the aftermath can be costly, but that’s where your insurance comes in!

Fast Facts:

Unfortunately, burst pipes are a common household issue, particularly in climates that experience significant temperature swings. The water damage caused by a burst pipe can be extensive, damaging not only the plumbing system but also your home’s structure and personal belongings.

Cold weather can cause water in your pipes to freeze. When water freezes, it expands, causing immense pressure on your pipes, potentially leading to a leak or burst. This issue predominantly affects pipes in unheated indoor areas like basements, attics, and roof spaces with minimal warm air.

A water pipe bursting can cause extensive damage to walls and flooring, which may require significant repairs.

Understanding what causes pipes to burst and how to prevent burst pipe in house is paramount for homeowners who want to avoid the stress of making a water damage insurance claim.

What Oakleafe Clients Say:

Several factors can lead to pipes bursting, each of which is important to be aware of to take preventative action.

The likelihood of experiencing a burst pipe can vary with the seasons. During winter, the risk increases significantly due to lower temperatures. Preemptive winterisation of your home’s plumbing system can dramatically reduce the risk. In contrast, summer might bring challenges, particularly when high temperatures increase water demand, potentially stressing the plumbing system.

Pipes bursting in the house is a common problem during winter. Some warning signs of water pipes burst in the home include unusual noises and moisture patches on ceilings or walls.

Early detection is crucial. Signs that may indicate a potential issue include:

Read about burst pipes outside your house.

Preventing burst pipes is preferable to dealing with the aftermath. To prevent a water pipe bursting, ensure your pipes are insulated properly. If you suspect a bursting water pipe, it is best to take proactive measures to prevent further damage.

Here are some steps you can take:

Quick action to prevent flooding is key if you discover a pipe burst in the home!

If you discover a frozen or burst pipe, acting quickly to minimise the damage is crucial.

First, turn off the water supply using your stop tap. This will halt any further water flow from the burst pipe.

Try to remove any belongings from the vicinity to limit the damage caused by escaping water. Your insurance company will need to know what loss or damage to your home has been caused, so taking pictures and making a detailed list of any affected items can speed up your insurance claims process.

Read about making a water damaged carpet insurance claim.

Steps for Dealing With Burst Pipes

Preventing burst pipes, especially water pipes bursting due to freezing, requires proactive measures. Always look for signs of a potential pipe burst in your home.

Read more about how much is the average insurance claim for burst pipe.

Once the immediate risk is mitigated, focus on cleaning up the water. Start by removing as much water as possible using towels, mops, and buckets. For larger volumes, consider renting a wet/dry vacuum. Prompt water removal is crucial to prevent mould and mildew growth.

After most of the water evaporates, fans and dehumidifiers dry the affected areas thoroughly. Open windows and doors to ensure good ventilation, and monitor moisture levels closely.

Professional water removal and restoration services may be necessary in cases of extensive flooding. These experts have specialised equipment to extract water, dry the premises, and treat areas prone to mould, expediting recovery.

Read about making a water damaged carpet insurance claim.

Once your claim is processed, focus on repairing and restoring your home. For minor damage, homeowners can attempt temporary fixes, but these should be addressed by a professional plumber for lasting solutions.

Plumbers can replace a damaged burst pipe in house, while contractors handle drywall repair, flooring restoration, and painting. Experienced professionals ensure repairs are done right and can help prevent future issues.

Consider engaging home restoration services that specialise in severe cases of water damage. They can assess the full extent of the damage and provide comprehensive restoration plans, including structural repairs and mould remediation.

Mr and Mrs R reported an escape of water claim in their remotely situated holiday home which suffered significant damage when a frozen pipe inside the loft burst. Damage included collapsed ceilings and water damage to the partition walls and to carpets, soft furnishings, and interior doors.

As their claim progressed, the insurers left the policyholders in the dark as very little progress had been made. After seven months, the insurers still hadn’t commenced drying works or carried out mitigation. Unhappy with the lack of communication and delays, Mr and Mrs R engaged Oakleafe Claims.

Despite the policyholders receiving a lack of support from insurers at the beginning of the claim, Oakleafe was able to achieve the best possible outcome for them. We obtained a sizeable cash settlement of £180,000, leaving the policyholders extremely happy with the outcome.

According to the Association of British Insurers, water damage is usually covered in your building insurance policy under Escape of Water. This can include burst pipes, leaking appliances, or an overflowing toilet. Escape of water damage is one of the most common types of domestic insurance claims, with insurance companies average insurance paying out £1.8 million every day for water damage in domestic properties.

Understanding your homeowner’s insurance policy is critical. Some policies might cover the damage caused by a burst pipe in your house but not the cost of replacing them. Familiarise yourself with the specifics of your policy and know whom to contact in case of an emergency.

To give yourself the best chance of having your claim accepted, you should:

Once the immediate threat is under control, it’s time to start your claim. Contact your insurance company to report the water leak immediately, providing them with all the incident details.

Include the steps you took to mitigate burst pipes to help show that you took reasonable steps to prevent the damage. This can include steps like having an approved plumber insulate your pipes or leaving your heating on to prevent pipes from freezing.

Remember, your insurance company might want a professional assessment of the damage. Involving an approved plumber early on can help fix the issue and provide a detailed report about the cause and extent of the damage. This report can be invaluable when making your insurance claim.

Expect your insurer to investigate all the details surrounding your burst pipe insurance claim. It’s a good idea to familiarise yourself with the circumstances surrounding the burst pipe in your home before submitting your claim so you’re not baffled when put on the spot. The insurance company will look at things such as:

Arm yourself with knowledge about these facts and circumstances to give confident and clear answers when submitting your insurance claim. After you’ve submitted your insurance claim, your insurer will send out a loss adjuster to assess the damage and report back to the insurance company.

The loss adjuster works on behalf of your insurance company. Your insurance company will provide you with a settlement figure based on their loss adjusters’ evaluations, likely to be the minimum necessary to cover the cost of restoring your home to its original condition.

Your insurer will not expect you to negotiate the figure, so, equip yourself with knowledge and use the following tips to confidently mediate a decent and proper settlement figure. It is recommended that you engage an independent loss assessor, such as Oakleafe Claims, to look over the small print of your policy to ensure you and your home are protected.

Understand your Insurance Policy

Understand your insurance policy, if necessary, with the help of a loss assessor such as Oakleafe Claims so you’re confident and able to dispute any falsehoods with your insurer. Let your insurer know you understand your policy, position and rights; your claim will likely be handled fairly and quickly. Familiarising yourself with your policy details also means you’re aware and knowledgeable about specific guidelines to follow for your burst pipe insurance claim. Your claim could be invalidated if you do not adhere to such policies.

Awareness and preparedness are your best defences against burst pipes. Regular maintenance, seasonal preparations, and knowing how to respond to an emergency can help mitigate the risks. By taking proactive steps today, you can prevent costly and inconvenient damage tomorrow. If you haven’t already, consider scheduling a professional inspection to ensure your plumbing system is in top condition.

Your home is one of your most valuable assets – protect it by staying informed and prepared.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial water damage claims with thousands of satisfied policyholders who have received their deserved insurance settlement.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP