A water leak in your home or business is not just a nuisance – it can be a formidable foe, costing UK households an estimated £697 million annually due to lost clean drinking water. This guide dives deep into the silent menace of water leaks, offering practical insights and strategies for homeowners to effectively detect, manage, and prevent water leaks.

From the surprising fact that 68% of UK households have experienced a water leak, yet over half are unsure how to detect it in common places like toilets, to understanding the extensive costs and damage they cause, Oakleafe Claims are here to equip you with the knowledge to protect your home and wallet. Let’s explore how to keep your home leak-free and efficient in conserving this precious resource.

Water Leaks – Fast Facts:

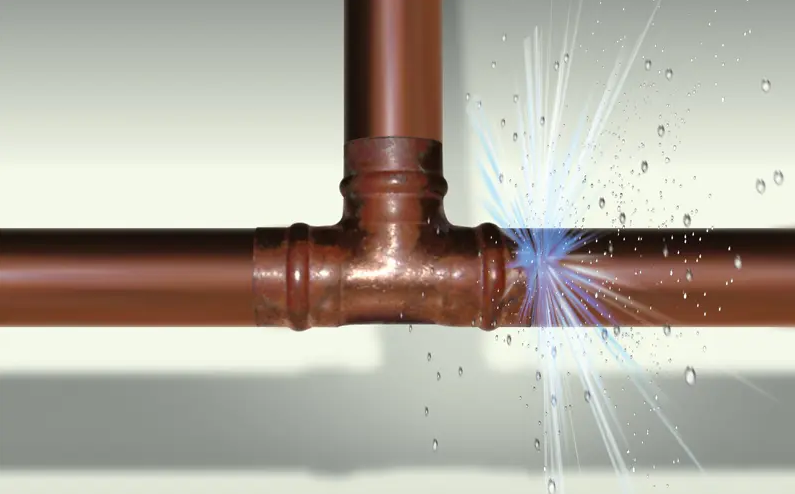

The threat of water leaks looms in every home. Whether it’s a dripping tap, a more sinister seepage hidden within walls or a burst pipe, the presence of water where it shouldn’t be is both a nuisance and a potential disaster. Oakleafe can help homeowners with this issue, offering advice, guidance, and full claims management should disaster strike.

What Oakleafe Clients Say:

Detecting a water leak is often akin to finding a needle in a haystack. However, one can unveil these hidden enemies armed with knowledge and vigilance. Here’s how:

The usual suspects of water wastage are often found in the bathrooms and kitchens. Toilets can silently leak at the flapper valve, while taps may drip away unnoticed. Addressing these common leaks promptly can save gallons of water.

Ignoring water leaks poses numerous risks. Here’s what lurks beneath the surface:

Upon identifying a leak, immediate action is paramount. Turn off your water supply, if necessary, to prevent further damage. For long-term peace of mind, consider regular inspections of pipes, appliances, and known trouble spots. Seasonal maintenance also plays a pivotal role in prevention, as does upgrading old and worn-out plumbing fixtures.

Sometimes, a leak may prove elusive or too complex for a DIY fix. This is where professional services come into play. When choosing a plumber or leak detection specialist, consider their accreditations, reviews, and the technology they use. A reputable professional can offer detection and repair services, ensuring your home remains dry and damage-free.

According to the Association of British Insurers, water damage from burst pipes and other leaks is usually covered in your building insurance policy under ‘Escape of Water’. Escape of Water damage is one of the most common types of domestic insurance claims, with insurance companies average insurance paying out £1.8 million every day for water damage in domestic properties.

What Oakleafe Clients Say:

Once the immediate threat is under control, it’s time to start your claim. Contact your insurance company to report the water leak immediately, providing them with all the incident details.

Including the steps you took to prevent the burst (like having an approved plumber insulate your pipes or leaving your heating on) can help to show that you took reasonable steps to prevent the damage.

Working with Professionals

Remember, your insurance company will probably want a professional assessment of the damage. Involving an approved plumber early on can help fix the issue and provide a detailed report about the cause and extent of the damage. This report can be invaluable when making your insurance claim.

Expect your insurer to investigate all the details surrounding your water damage insurance claim. It’s a good idea to familiarise yourself with the circumstances surrounding the burst pipe in your home before submitting your claim so you’re not baffled when put on the spot. The insurance company will look at things such as:

Arm yourself with knowledge about these facts and circumstances to give confident and clear answers when submitting your insurance claim. After you’ve submitted your insurance claim, your insurer will send out a loss adjuster to assess the damage and report back to the insurance company.

The loss adjuster works on behalf of your insurance company. Your insurance company will provide you with a settlement figure based on their loss adjusters’ evaluations, likely to be the minimum necessary to cover the cost of restoring your home to its original condition.

Your insurer will not expect you to negotiate the figure, so equip yourself with knowledge and use the following tips to confidently mediate a decent and proper settlement figure. It is recommended that you engage an independent loss assessor to look over the small print of your policy, such as Oakleafe Claims, to ensure you and your home are protected.

While common, water leaks should never be considered trivial. Neglect can have costly and dangerous repercussions. We urge homeowners and property managers to adopt a proactive stance: inspect regularly, repair promptly, and consult a professional when in doubt.

In troubled waters, forewarned is forearmed. Should suspicions arise, don’t hesitate – act, for the well being of your home depends on it.

Remember, your feedback is invaluable. Share your thoughts, experiences, or queries below, and if this guide resonates with or assists you, kindly pass it on. Together, we can reverse the course of water leaks, drip by drip.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial water damage insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement.

What is Not Covered by Building Insurance?

Building insurance typically provides a safety net for various kinds of structural damage to your home, including certain types of water damage. However, you should note that not all scenarios are covered. Exclusions often include damage from wear and tear or gradual decline over time.

Additionally, some policies might not cover the damages if your home was unoccupied for over 60 days. It’s crucial to read the fine print and understand these limitations, as each policy is different.

Is Plumbing Covered by Building Insurance?

The coverage for plumbing in building insurance can be complex. In general, damage caused by a burst pipe, leaking pipes or an ‘escape of water’ is often included. However, the cost of repairing the actual pipe may not be covered. This distinction between the resultant damage and the source of the problem is a key aspect to consider when assessing your policy.

Who Pays for Water Leak Damage?

When it comes to water leak damage, the responsibility typically falls under the home insurance cover. If the damage caused by the leak is accidental, your building insurance should cover the cost of repairing it. However, if the leak results from negligence or lack of maintenance, you might have to bear the expenses.

Are My Contents Covered By Building Insurance?

While building insurance covers the structure, contents insurance is essential for protecting your belongings. In the event of water damage, contents insurance can cover the cost of repairing or replacing damaged items within your home, ensuring you’re not left at a financial loss.

What’s the Impact of Wear and Tear on My Claim?

One common misunderstanding is the role of wear and tear in insurance claims. Building insurance does not cover damage resulting from gradual wear and tear. Regular maintenance of water pipes and heating systems is essential to prevent such issues and ensure your claim is valid.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP