Dealing with flood insurance claims is one of the most stressful experiences homeowners face, especially when your home is flooded. Unfortunately, what many don’t realise is that insurance companies appoint loss adjusters specifically to protect their interests and minimise your settlement.

Insurance for flooding can be particularly challenging to navigate because different insurers have different approaches to handling building work and repairs. When filing a home insurance flood claim, you’ll likely need to negotiate with loss adjusters to secure a fair settlement amount. Indeed, water damage insurance claims require careful attention to detail, especially considering floods are among the most challenging disasters for UK homeowners. This comprehensive guide will help you understand what insurers won’t tell you about your flood insurance UK policy, and how Oakleafe can support you through every step of the claims process to ensure you receive the settlement you deserve.

Many property owners discover the harsh realities of a flood insurance claim only after flood water has already damaged their homes. Understanding how these claims actually work can save you thousands of pounds and countless headaches.

The most critical distinction you need to know is that a standard home insurance policy never covers flood damage. While your home insurance policy typically covers water damage from internal sources like burst pipes or overflowing toilets, it completely excludes damage from external rising water.

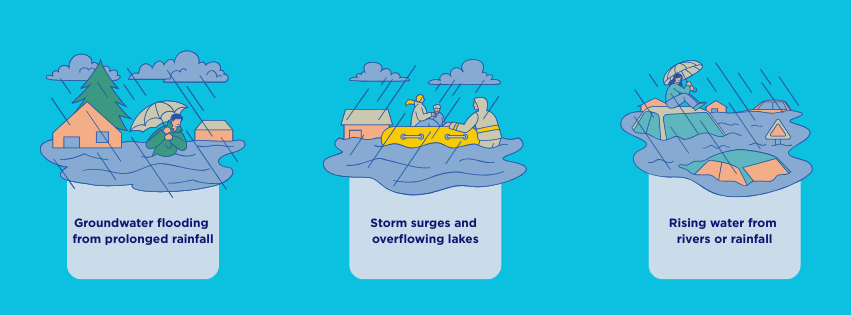

Flood insurance specifically covers water that touches the ground before entering your property, including:

Furthermore, flood and home insurance often come from different providers. Most home insurance comes from private companies, whereas flood coverage is available through either the National Flood Insurance Programme (NFIP) or private insurers.

After a flood, every hour counts. Reporting your claim promptly isn’t just good practice, it can be the difference between approval and denial. In fact, failing to report claims quickly could violate your policy terms and result in your claim being rejected altogether.

Most insurance companies require you to file a notice of loss detailing the damage type as soon as possible. Once this notice is filed, a loss adjuster should contact you within 48 hours to confirm your claim and schedule an inspection. Subsequently, you must submit proof of loss within 60 days of the flooding event.

While you’re focused on getting back into your flooded home quickly, insurers are primarily concerned with minimising their costs. This fundamental difference in priorities creates tension throughout the insurance claim process.

After a major flood, insurance companies typically appoint loss adjusters whose job is to assess damage and keep costs down. Although they present themselves as helpful advisors, their actual role is to protect the insurer’s interests, not yours.

The standard flood claims process involves cleaning, stripping out flood damaged items, disinfecting, and drying your property before repairs begin. However, insurers often underestimate the true cost of restoring your home to its pre-flood condition.

Most importantly, you should know that if your home is badly damaged by flooding, complete restoration can take up to a year or longer, primarily due to the extensive drying time required. During this period, emergency accommodation and additional expenses should be covered by your policy, though insurers rarely volunteer this information upfront.

When insurance companies present their first offer for your flood insurance claims, remember it’s typically their starting position, not their final one. Negotiating effectively requires knowing what insurers prefer to keep quiet.

Never accept the initial settlement offer without question. Instead, gather evidence of all damages, including photographs and independent contractor quotes. If the insurer’s figure seems low, formally request a detailed breakdown of how they calculated their offer.

Remember that loss adjusters serve the insurer’s interests, not yours. Always accompany them during property inspections and take your own photos simultaneously. Keep communications in writing where possible, and don’t volunteer information beyond what’s requested. Most importantly, never sign any insurance documents without understanding their implications fully.

After experiencing a flood, you can request “resilient repairs” rather than simple replacements. These might include waterproof plaster, raised electrical sockets, or concrete floors instead of wooden ones. Nevertheless, insurers rarely suggest these options unprompted, you must specifically request them during negotiations.

Throughout this process, Oakleafe’s expertise can prove invaluable, ensuring your flooding insurance claim includes all entitled elements while effectively challenging undervalued assessments from insurer-appointed adjusters.

Consider hiring a loss assessor when facing a complex claim or significant damage. Unlike loss adjusters who work for insurers, loss assessors represent your interests exclusively. They typically secure settlements higher than unrepresented claimants and often pay for themselves through the increased settlement.

What Oakleafe Clients Say:

The hidden clauses in your flood insurance claims paperwork often contain crucial details that only become apparent when you need to make a claim. Understanding these overlooked elements can make a significant difference in your settlement outcome.

Your flooding insurance policy likely contains several exclusions that insurers rarely emphasise. Most policies exclude damage to fences, gates, and garden walls, even when they’re destroyed by the same flood that damaged your home. Additionally, external structures like sheds and garages often have separate, lower coverage limits.

Moreover, gradual water ingress, even if caused by poor drainage following a flood, typically falls outside standard coverage. Damage resulting from groundwater seepage is likewise commonly excluded unless specifically mentioned in your policy.

Despite what many believe, alternative accommodation provisions vary greatly between policies. Most insurers cap temporary housing reimbursement at 20% of your total sum insured, regardless of actual rental costs in your area.

Unlike what’s commonly assumed, insurers can restrict accommodation options to their “preferred network” of properties. Consequently, you might be forced to relocate far from your workplace or children’s schools.

Generally, insurers also impose strict time limits on emergency accommodation benefits, regardless of how long repairs actually take. This means you could face out-of-pocket expenses if drying and restoration work extends beyond policy timelines.

The average insurance payout for water damage in the UK frequently falls short of actual restoration costs because of hidden claim limits. Many policies contain “matching items” clauses that only cover damaged items directly affected by flood water, not undamaged items that form part of a matched set.

Insurers often apply depreciation to contents claims, regardless of replacement cost. For instance, a five-year-old sofa might only receive 50% of its original value despite current replacement costs being higher.

Instead of leaving you to navigate these complexities alone, Oakleafe specialises in identifying these loopholes and ensuring your flood insurance UK claim accounts for every entitled penny, ultimately securing settlements up to 40% higher than unrepresented claims.

Making the right moves after flood damage can significantly increase your flood insurance claim settlement. Avoiding these common pitfalls ensures you receive the compensation you deserve.

Thorough documentation forms the backbone of successful flood insurance claims. After flooding, immediately create a detailed record of all communications with your insurance company, noting who you spoke with, when, and what was agreed. Maintain copies of all correspondence and store receipts for emergency repairs that you’ve paid for yourself. Additionally, take comprehensive photos of flood damaged items before disposal, as these serve as critical evidence during claim assessment.

Initial settlement offers frequently undervalue the true extent of water damage. Prior to accepting any proposal, obtain independent contractor estimates to determine actual repair costs. This comparison provides leverage for negotiation if the insurer’s offer falls short. Remember, you have every right to challenge assessments that don’t adequately cover your losses.

Many policyholders fail to realise that outbuildings like sheds and garages typically have separate coverage limits. Most insurers also exclude flood damage to garden items unless specifically covered. Furthermore, while debris removal from grounds is typically covered, damage to gates, fences and hedges usually isn’t.

After significant flooding, you may qualify for up to 12 months of council tax exemption if your property becomes uninhabitable. This applies whether you’ve relocated or are living in just part of your home while repairs continue. Contact your local council promptly to apply for this relief, most require documentation confirming the extent of damage.

If you have experienced damage from floods, get in contact with Oakleafe for expert assistance.

Flood insurance claims can be complex and overwhelming, but understanding how they work is key to securing a fair settlement. Quick action, detailed documentation, and knowing the difference between flood insurance and standard home insurance can make or break your claim.

Remember, loss adjusters work for insurers, not for you. That’s why many homeowners end up with flood insurance claim payouts far below what they deserve. By challenging first offers, collecting independent evidence, and seeking expert support, you stand a much stronger chance of success.

Common mistakes, like poor documentation, rushing to accept low offers, or overlooking flood resilient upgrades, can cost thousands. At Oakleafe, we specialise in handling flood insurance claims and regularly achieve settlements for unrepresented claimants.

The best way to avoid having to make flood insurance claims is to protect your home for floods in the first instance. If you need help protecting your home before a flood occurs you can find flood protection guides at citizens advice.

Flood insurance claims aren’t just about money, they’re about restoring your home and peace of mind. With professional guidance, you can approach the process with confidence and secure the full compensation your policy promises.

Please complete the form and one of our insurance claim professionals will call you back ASAP