Flood insurance claim process. Flooding doesn’t just destroy property – it upends lives. Whether you’re a homeowner watching cherished belongings float away or a business owner dealing with costly downtime, the emotional and financial toll can feel overwhelming. And when you’re still reeling from the damage, trying to figure out your flood insurance policy or where to start with your claim can feel like another disaster in itself.

This guide is designed to cut through the confusion. We’ll walk you through what constitutes flood damage, what to do immediately after a flood, and how to handle your insurer and their loss adjusters. If you’ve ever worried that your claim might be denied or undervalued, this article will help you take control of the process – and protect what matters most.

Floods don’t just mess up your home – they mess up your life. It can be extremely upsetting, and it is costly to repair. This guide helps individuals understand what to do in the event of a flood affecting their home or business.

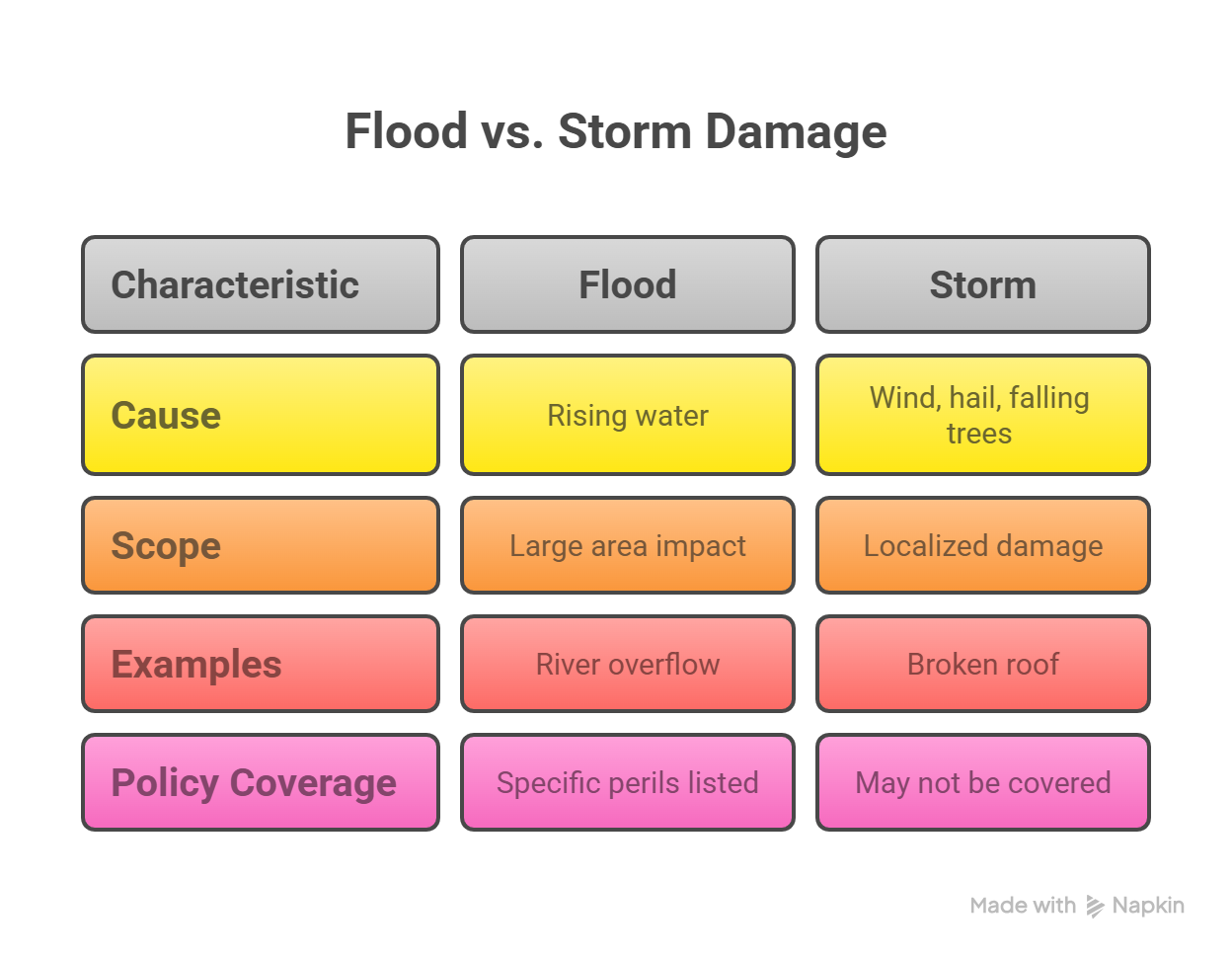

Not All Water Damage Is the Same

Floods occur when water from rivers or rain enters your house. But if a pipe breaks or rain gets in through the roof, that’s different – and your insurance might not cover it.

Check Your Insurance Carefully

Some insurance pays for fixing your house (such as the walls and floors), while others pays for your belongings (like your clothes and games). However, items like jewellery might not be fully covered unless you request additional protection.

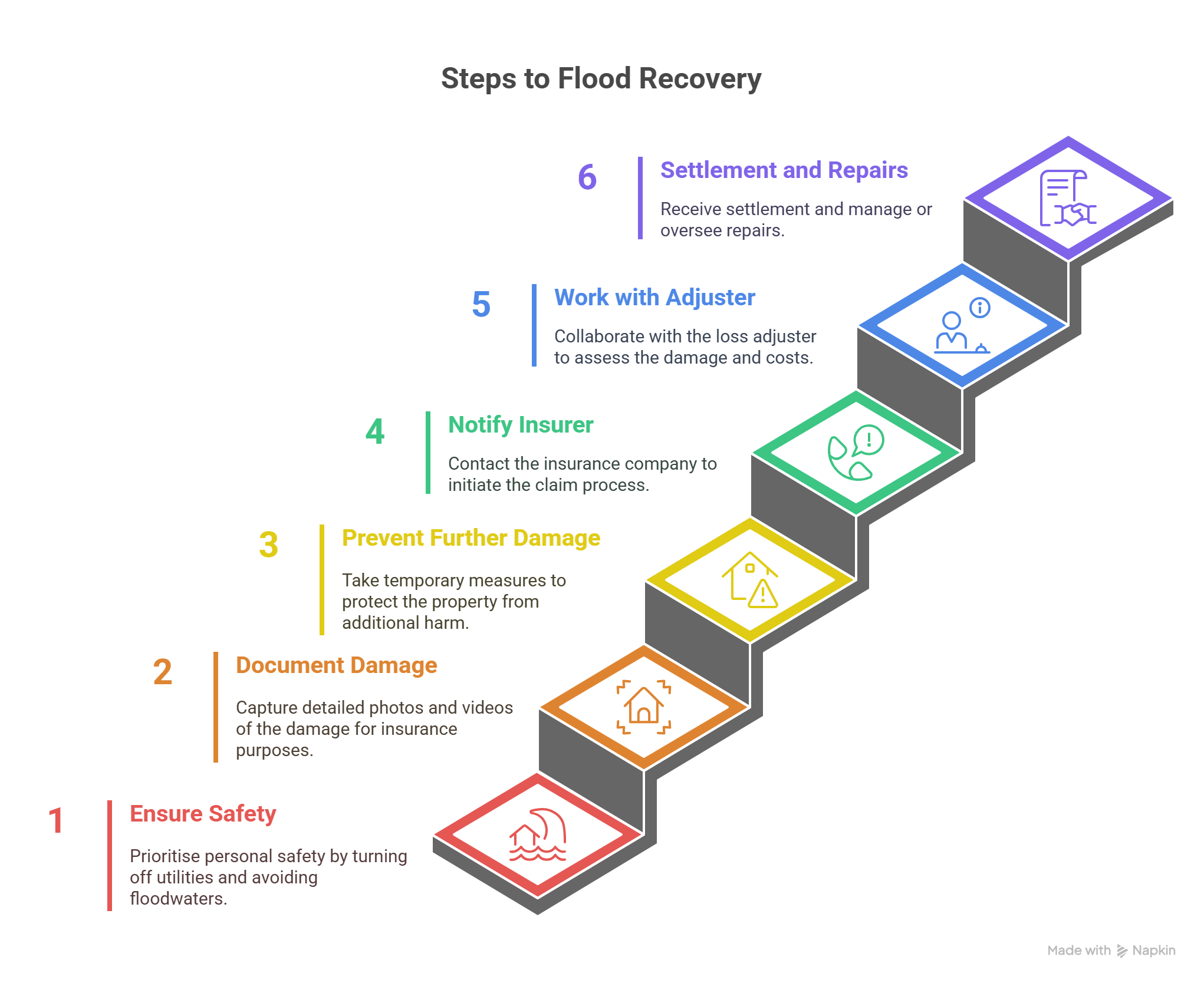

Act Fast After a Flood

Start Your Claim

Tell your insurance company what happened. Share your photos and a list of damaged items.

Who Checks the Damage?

The insurance company sends someone called a “loss adjuster.” They assess the damage and determine how much compensation you should receive.

What If You’re Not Happy With the Result?

You can get help from someone called a “loss assessor” who works for you, not the insurance company. They’ll fight to get you what you deserve.

Fixing Things

You can either:

If Your Claim Is Denied

Don’t give up! You can argue back with proof or even get help from a complaints service.

Before you file a claim, it’s crucial to know what insurers actually classify as flood damage. Many people assume any kind of water damage qualifies, but insurance companies draw a sharp line between different types of water-related incidents.

Flood damage typically results from rising water entering your property, usually due to overflowing rivers, heavy rainfall, or coastal storm surges. It must usually impact more than one property or a large area to qualify.

Storm damage, by contrast, is often caused by wind-driven rain or physical damage from hail, falling trees, or flying debris. Leaks from a broken roof or burst pipe during a storm may not be covered under flood insurance.

Your policy will list specific flood scenarios it covers – these are known as insured perils. Generally, this includes:

Review your policy language carefully. Misunderstanding what’s defined as “flood damage” could delay or even invalidate your flood insurance claim process.

What Oakleafe Clients Say:

Flood policies typically consist of two main parts: building coverage and contents coverage.

Buildings cover protects the physical structure of your home or business. This includes walls, floors, foundations, and key systems such as plumbing and electricity.

Contents coverage refers to your personal belongings, including items such as furniture, clothing, electronics, and kitchen appliances. However, items such as jewellery, art, or antiques may only be partially covered unless you’ve taken out additional protection.

Understanding these categories helps you document losses properly and avoid surprises during the claims process.

Most policies contain exclusions. For example, damage caused by poor property maintenance or delayed action might not be covered. Similarly, any mould or mildew that develops due to inaction could be excluded.

You’ll also have an excess – the amount you must pay before your insurer contributes – and policy limits, which cap how much you can claim. Some insurers offer add-ons or endorsements to extend these limits if needed.

How you respond in the first 24 – 48 hours after a flood can make or break your claim. Here’s what to focus on:

1. Stay Safe First

If it’s safe, switch off your power and gas. Don’t enter floodwaters – aside from potential contamination, hazards like glass, nails, or structural damage may be hidden below the surface.

2. Document Everything

Take clear, high-resolution photos and videos of the damage before you start cleaning up. Focus on floors, walls, furniture, appliances, and any valuables. Then create a written inventory, noting when items were purchased and their estimated value. This will help you in your flood insurance claim process.

3. Prevent Further Damage

Temporarily repair anything that could cause more loss – board up broken windows, cover leaking areas, and move salvageable items. But don’t dispose of damaged goods unless they pose a health risk; your insurer or their adjuster will need to inspect them.

Once you’ve ensured safety and collected evidence, it’s time to start the flood insurance claim process.

Your insurer will appoint a loss adjuster to assess the damage. Their report helps determine whether your claim is approved and how much you’ll receive.

What Does a Loss Adjuster Do?

Tips for a Smoother Assessment

If the adjuster’s report seems to undervalue your losses, you have the right to hire a loss assessor – someone who represents you, not the insurer, and ensures your claim is treated fairly.

After reviewing the adjuster’s report, your insurer will issue a settlement. This typically happens in one of two ways:

Whichever route you take, make sure you:

Not all claims go smoothly. If yours is rejected – or you’re offered far less than expected – don’t give up. on the flood insurance claim process.

Common Reasons for Denial

How to Fight Back

Persistence pays off. Many claims are approved or adjusted after appeal, especially when a loss assessor is involved.

The flood insurance claim process is never easy, but it doesn’t have to be a battle. With the right knowledge, clear records, and expert assistance, you can regain control and safeguard your future.

If you’re unsure whether your claim is on the right track or you simply don’t want to deal with the stress, working with a professional loss assessor can make all the difference.

At Oakleafe Claims, we work for you, not the insurer. Our expert loss assessors are here to handle your entire flood insurance claim – from first contact to final settlement. We make sure your claim is fully documented, fairly assessed, and paid out as it should be.

Let us remove the pressure and get you the outcome you deserve.

Contact us today to speak with an expert and start your recovery on the strongest possible footing.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP