Water damage claims flood home insurance. Dealing with water damage in your home is overwhelming – not just because of the physical mess, but also because of the stress, uncertainty, and financial risk that accompany it. Whether it’s a burst pipe or a sudden flood, the aftermath can leave you feeling helpless and unsure where to turn. But here’s the truth: the right knowledge can give you back control.

This guide breaks down the often-confusing world of water damage insurance claims in a way that’s clear, practical, and focused on protecting your interests. You’ll learn the crucial difference between “flood” and “escape of water,” how to act fast to avoid claim rejections, and how professionals like loss assessors can be your greatest ally.

Two types of water damage:

Act fast!

As soon as you see damage, tell your insurance company. Don’t wait, or they might not help.

Keep proof:

Take pictures, save receipts, and document what was damaged.

What happens next:

An insurance person checks your house, you send them info, and they offer money to fix things.

Get help if needed:

A loss assessor works for you, not the insurance company. They ensure that you are treated fairly.

You might get to stay somewhere else:

If your home is too damaged, your insurance may cover the cost of a hotel or rental until it’s repaired.

Why claims get rejected:

Prevent problems next time:

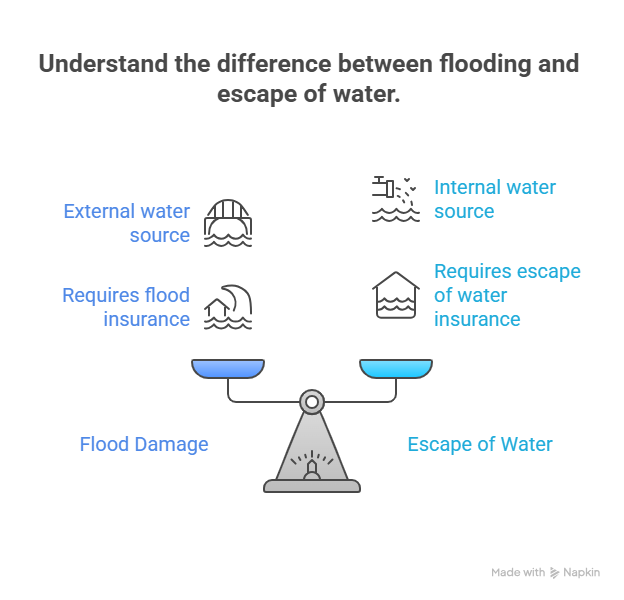

One of the most common areas of confusion when it comes to home insurance claims lies in distinguishing between flood damage and escape of water. While both result in water damage, they are classified differently under your insurance policy.

What is Flood Damage?

Flood damage typically refers to instances where water inundates your home due to natural causes such as heavy rain, overflow from rivers, or storm surge. This type of damage often requires a comprehensive flood insurance policy, especially if your property is in a designated flood zone.

What is Escape of Water?

Escape of water, on the other hand, pertains to damage caused by water leaking or escaping from inside your home, such as a burst pipe, a faulty washing machine, or an overflowing bathtub.

Examples of Each:

Understanding this distinction is crucial, as the type of water damage determines whether your claim falls under flood insurance or escape of water insurance.

What Oakleafe Clients Say:

Knowing when to initiate an insurance claim is essential to streamline the process and improve your chances of approval.

Triggers to File a Claim

Common scenarios that necessitate claims include:

Timelines and Deadlines

File the claim as soon as possible after discovering the damage. Many insurance policies impose strict time limits for notifying your insurer. Failing to report in time may lead to denial of your claim.

Immediate Actions to Take

Once your claim is initiated, your insurer will take you through a defined process. Here’s what generally happens.

1. Assignment of a Claim Reference Number

Your insurer will provide you with a unique reference number tied to your claim.

2. Site Inspection

A loss adjuster or surveyor will visit your property to assess the damage and verify your claim.

3. Documentation and Evidence Submission

Prepare and submit all necessary documentation, including photos, repair quotes, and proof of ownership for damaged items.

4. Damage Assessment

The insurer will evaluate whether the damage is covered under the policy and the estimated cost of repairs.

5. Settlement Offer

If your claim is approved, you’ll receive an offer to cover the costs of repairs or replacements.

Loss adjusters can be crucial in ensuring a fair settlement; however, it’s essential to understand their role and how they operate.

Who Are Loss Adjusters?

Loss adjusters work on behalf of the insurer to:

Although they’re meant to act independently, their ultimate goal is to protect the insurer’s financial interests.

Should You Hire a Loss Assessor?

Unlike loss adjusters, a loss assessor is hired by you, the policyholder, to represent your interests. They can:

If you feel that your claim is being undervalued or unjustly denied, hiring a loss assessor can level the playing field.

Dealing with extensive water damage often requires temporarily leaving your home. Many insurance policies provide coverage for additional living expenses, including alternative accommodations.

What’s Covered?

How to Claim for Alternative Accommodation

Check your policy for a subsection on temporary accommodation cover and include all relevant documents (e.g., hotel receipts) in your claim.

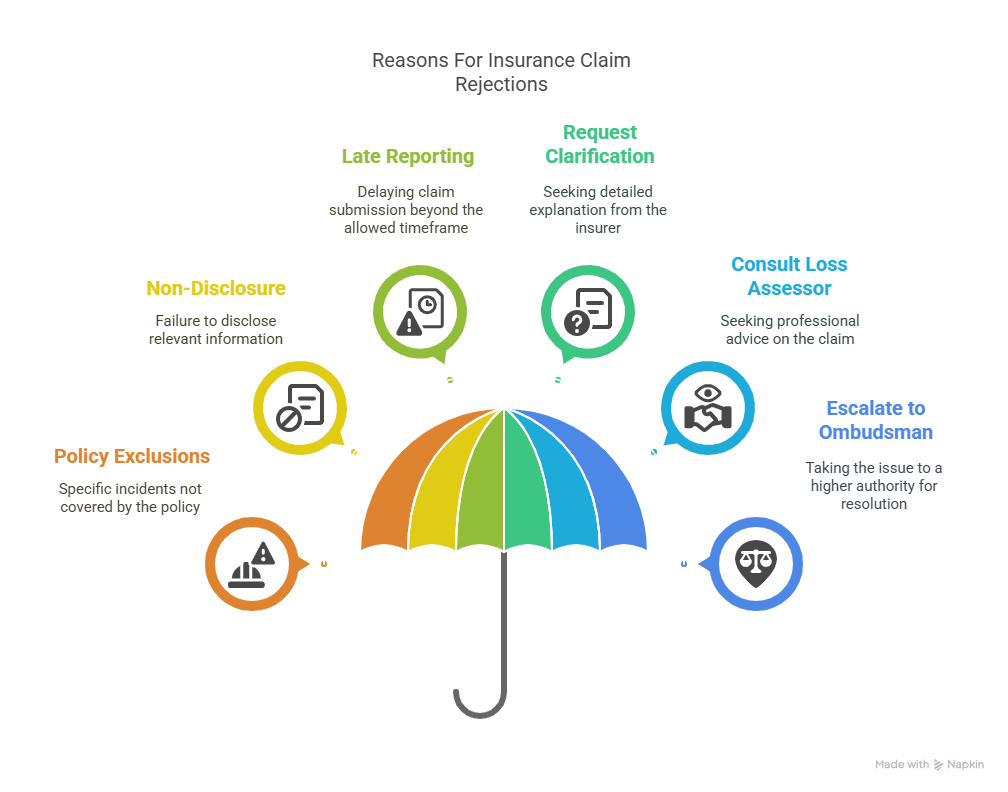

Here are some of the most common reasons for a claim rejection:

1. Policy Exclusions

Many policies exclude specific incidents, such as pre-existing damage or wear and tear.

2. Non-Disclosure

Failing to disclose past claims, property modifications, or residing in a flood-prone area can lead to denial.

3. Late Reporting

Delaying your claim submission beyond the allowed timeframe is one of the most common reasons for rejection.

You can take the steps below if your claim gets denied:

While insurance protects against financial losses, prevention is always better. Here are practical measures to reduce the risk of water damage.

Maintenance Tips

Upgrades Worth Investing In

Proactively implementing these measures can also help lower your insurance premium, as many providers offer discounts for improved property resilience.

Water damage might strike without warning, but your response doesn’t have to be uncertain or reactive. With a solid understanding of the claims process and a few proactive steps, you can reduce stress, protect your finances, and get back on your feet faster.

Here’s a quick recap of what you’ve learned:

Next Steps:

Oakleafe Claims is here to stand by your side, offering expert guidance through the insurance maze when you need it most.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP