How much does subsidence devalue a property? Subsidence can be a major concern for homeowners, affecting not only the stability of a property but also its market value. If you’ve noticed cracks in walls, sticking doors, or uneven floors, subsidence might be the culprit. But how much does subsidence devalue a property? Buyers are often hesitant regarding properties with a history of subsidence, as they may face substantial repair costs and insurance complexities.

This article examines how much does subsidence can devalue a property, typical repair costs, and practical advice for selling or insuring a subsidence-affected home. With this knowledge, you’ll have a clearer idea of managing and possibly restoring your property’s value.

Impact on Property Value

Factors Influencing Devaluation

Future Trends

In summary, subsidence presents a significant challenge for property owners in the UK, leading to considerable devaluation and complicating sales and insurance processes. As climate change influences geological stability, the issue will likely grow more pressing in the coming decades.

To understand how much subsidence devalues a property, it’s essential to first understand subsidence. Subsidence is the gradual sinking or settling of the ground beneath a property, often resulting in significant structural damage.

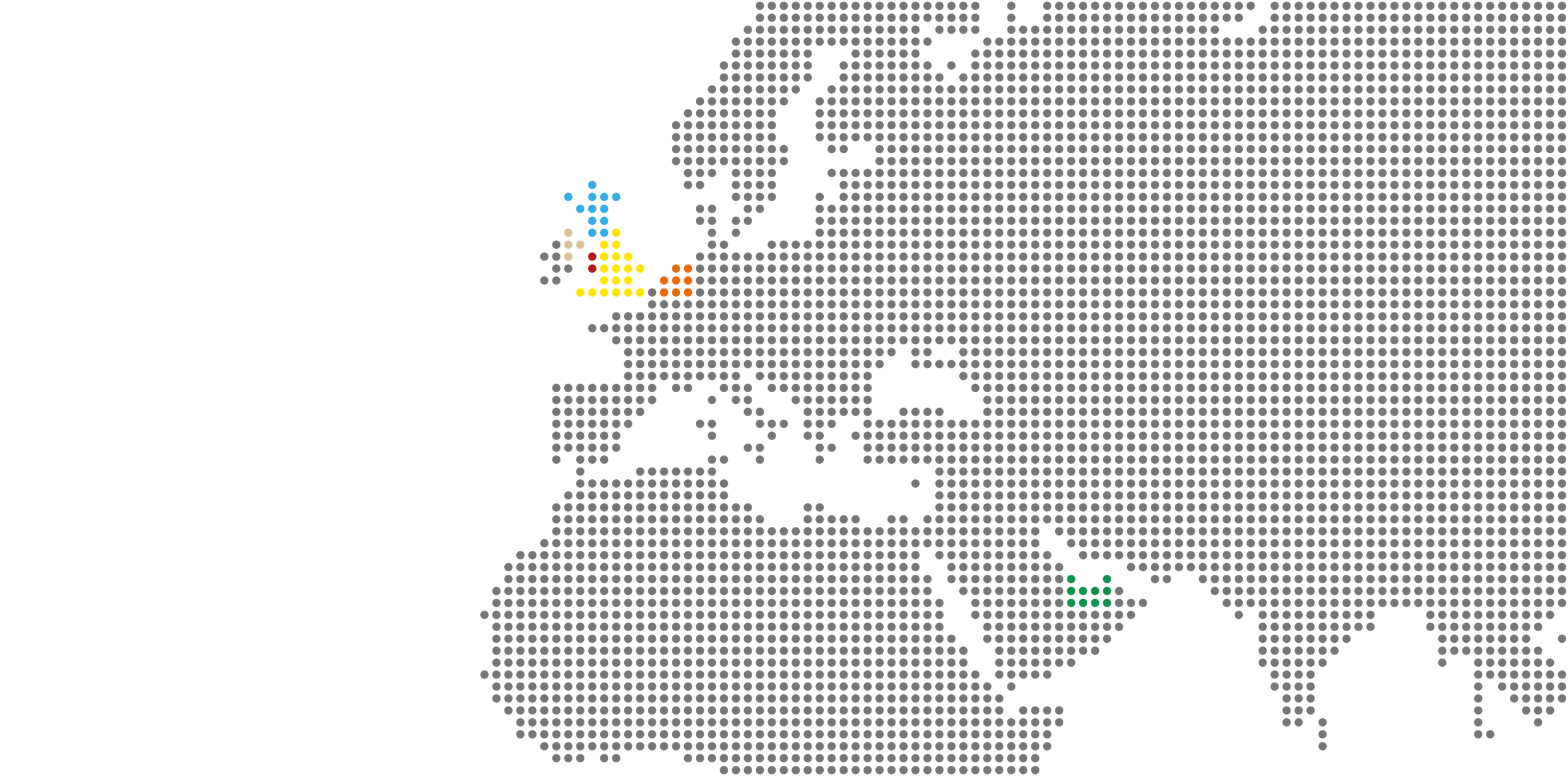

While subsidence can occur anywhere, it’s more prevalent in areas with certain soil types and environmental conditions. Soil instability can cause shifts in a building’s foundation, manifesting as cracks in walls, sticky doors, or uneven floors.

Regions with clay soil, which tends to expand and contract with moisture changes, are at high risk of subsidence. Properties in these areas may be more vulnerable to subsidence, making it a key consideration for buyers and investors alike.

Understanding what causes subsidence is crucial for both prevention and mitigation. Several factors contribute to this issue:

Awareness of these causes enables homeowners to take proactive steps, like maintaining drainage systems and careful tree placement, to help mitigate the risk of subsidence.

What Oakleafe Clients Say:

Book your complimentary consultation with our insurance claim professionals.

Our insurance claim professionals will explain the claim process to ensure you understand your options.

Spotting subsidence early can save property owners significant trouble and expense. Here are some common indicators:

By being vigilant and addressing these signs promptly, homeowners can prevent further damage and preserve the value of their property.

The financial implications of subsidence can be significant. Properties affected by subsidence often see a reduction in market value. The question is: how much does subsidence devalue a property?

The extent of devaluation varies. Factors such as the severity of the issue, the property’s location, and whether repairs have been undertaken all play a role. On average, subsidence can decrease a property’s value by 10 – 20%.

Buyers are often wary of properties with a history of subsidence due to potential repair costs and the risk of future issues. However, properties with a documented history of successful repair and underpinning may experience less devaluation

Addressing subsidence requires professional intervention. One common method for repairing subsidence is underpinning, which involves strengthening the foundation to prevent further movement.

Underpinning is not a cheap fix. The cost of fixing subsidence can vary widely, influenced by factors such as the severity of the subsidence and the property’s size. Homeowners might expect to pay anywhere from £5,000 to £50,000 or more for this procedure.

While expensive, underpinning can significantly enhance a property’s stability and sometimes restore its value by reassuring future buyers about its structural integrity.

Subsidence can complicate home insurance for affected properties, often leading to increased premiums and potentially limited coverage.

Insurance companies view subsidence as a high-risk factor, which can justify higher premiums. Additionally, policies may include exclusions or limitations related to pre-existing subsidence, resulting in subsidence claims that are not paid out. For homeowners, it’s essential to discuss these factors with their insurance provider. Understanding coverage and policy limits can prevent unwelcome surprises when filing a subsidence claim.

Repairing subsidence goes beyond underpinning. Various other issues can contribute to the subsidence repair cost, such as:

Considering these elements, the cost of fixing subsidence can add up quickly. However, addressing these issues is essential to prevent recurrence and restore the property’s value.

Read more about claiming subsidence on home insurance policies.

Selling a property affected by subsidence presents unique challenges. Many buyers are hesitant to invest in properties with potential structural issues. However, sellers can overcome these hurdles with some strategic approaches:

By adopting these strategies, sellers can increase their chances of a successful sale while ensuring buyers feel informed and confident in their purchase.

Preventing subsidence is often more cost-effective than dealing with its consequences. Here are some preventative measures homeowners can take:

These steps can reduce subsidence risks, helping safeguard the property and its value over time.

Understanding how much subsidence devalues a property is vital for homeowners, investors, and buyers alike. Here’s a quick recap:

While subsidence can significantly impact property value, taking proactive measures, seeking professional advice, and being transparent can help mitigate its effects. Property owners can protect their investments, maintain marketability, and achieve a successful sale by doing so.

For those seeking further support, contacting a qualified professional can provide valuable guidance tailored to individual circumstances. Whether you want to prevent, repair, or sell, informed decisions are key to safeguarding your property’s value.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement. We can also help if you have had a subsidence claim rejected. With no upfront fees required, our internal data shows that insurance claims managed by professional loss assessors like Oakleafe can expect a settlement up to 40% higher than claims managed by the policyholder.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP