How to Claim a New Roof on Your Homeowners Insurance – Filing an insurance claim for a new roof might feel like stepping into a maze. However, with the right steps and a solid understanding of the claims process, you can successfully file a claim and get your roof replaced without unnecessary stress.

In this comprehensive guide, we’ll walk you through everything you need to know about how to claim a new roof on your homeowners insurance policy. From understanding your coverage to dealing with insurance adjusters and contractors, we’ve got you covered.

Most home insurance policies provide coverage for roof repairs, but the extent of this coverage can vary significantly. Generally, full coverage for roof repairs is rare; most policies only cover part of the costs. Full coverage is typically available if:

When assessing a claim for roof repairs, insurance companies consider several key factors:

Before you can file a claim, it’s crucial to understand what your homeowners insurance policy covers. Not all policies are created equal, and knowing the specifics can significantly affect your claim’s success.

What Does Your Policy Cover?

The first step is to read through your policy carefully. Look for sections that discuss roof coverage, paying close attention to any exclusions or limitations. Some policies only cover specific types of damage, like those caused by storms, fires, or accidents. Others may exclude wear and tear or neglect, which are common reasons claims get denied. Knowing how to claim a new roof on your homeowners insurance starts with understanding these nuances.

Full Replacement vs. Partial Repairs: What Does Your Policy Offer?

Homeowners insurance typically offers two types of coverage:

Knowing whether your policy offers full replacement or only partial repairs is crucial to managing your expectations and avoiding unexpected out-of-pocket expenses. For example, older roofs may only be eligible for partial repairs due to depreciation.

Key Terms and Clauses Related to Roof Damage Coverage

To understand how to claim a new roof on your homeowners insurance and navigate the claims process smoothly, familiarise yourself with these crucial insurance terms:

What Oakleafe Clients Say:

Book your complimentary consultation with our insurance claim professionals.

Our insurance claim professionals will explain the claim process to ensure you understand your options.

Before you can file a claim, it’s crucial to understand what your homeowners insurance policy covers. Not all policies are created equal, and knowing the specifics can significantly affect your claim’s success.

What Does Your Policy Cover?

The first step is to read through your policy carefully. Look for sections that discuss roof coverage, paying close attention to any exclusions or limitations. Some policies only cover specific types of damage, like those caused by storms, fires, or accidents. Others may exclude wear and tear or neglect, which are common reasons claims get denied. Knowing how to claim a new roof on your homeowners insurance starts with understanding these nuances.

Full Replacement vs. Partial Repairs: What Does Your Policy Offer?

Homeowners insurance typically offers two types of coverage:

Knowing whether your policy offers full replacement or only partial repairs is crucial to managing your expectations and avoiding unexpected out-of-pocket expenses. For example, older roofs may only be eligible for partial repairs due to depreciation.

Key Terms and Clauses Related to Roof Damage Coverage

To understand how to claim a new roof on your homeowners insurance and navigate the claims process smoothly, familiarise yourself with these crucial insurance terms:

What Oakleafe Clients Say:

Book your complimentary consultation with our insurance claim professionals.

Our insurance claim professionals will explain the claim process to ensure you understand your options.

Knowing the types of roof damage your insurance covers can help you build a compelling case for your claim on how to claim a new roof on your homeowners insurance.

Severe Weather (Wind, Hail, and Hurricanes)

Most policies cover impact damage caused by severe weather events, such as windstorms, hail, or hurricanes. Understanding how to claim a new roof on your homeowners insurance means documenting the event effectively. Save weather reports, news articles, or other evidence that supports the damage as part of a covered peril. The more proof you can provide, the stronger your claim will be.

Leaks and Water Damage: Are They Covered?

Water damage caused by a storm is usually covered if the damage is sudden and accidental. For example, if the wind blows off shingles and water leaks through the roof, that should be covered. Roof collapses due to the weight of snow or ice are also typically included, but this varies by policy. Always review your policy’s terms to confirm coverage.

Cosmetic Damage vs. Structural Damage

Cosmetic damage might not be covered, such as slight discolouration or surface-level scratches. However, any structural damage compromising the roof’s integrity (like sagging beams or cracked shingles) is usually eligible for a claim. Document it thoroughly, even if the damage appears minor, as cosmetic issues can sometimes mask larger structural problems.

Proper documentation is critical to a successful roof insurance claim. Here’s how to gather the evidence you need.

Take Photos and Videos From Every Angle

Don’t skimp on the photos. Capture close-ups of damaged shingles, cracks, leaks, and even water stains inside the home. Take multiple shots from different angles – this visual proof can make all the difference when your claim is reviewed.

Get a Professional Inspection Report

Hiring a certified roofing inspector provides an unbiased, professional opinion on the extent of the damage. Their report, often accompanied by photos, can substantiate your claim and speed up the approval process.

Describe the Damage in Detail

When describing the damage to your insurer, be specific. Use terms like “missing shingles,” “water infiltration,” or “structural sagging.” Avoid vague statements like “the roof looks bad.” Precision will help adjusters assess the extent of the damage and approve your claim faster.

Filing your claim properly is essential to getting the compensation you deserve. Here are the key steps to follow:

Notify Your Insurer Right Away

Contact your insurance agent as soon as you discover the damage. Provide them with all the evidence you’ve gathered—photos, videos, inspection reports—and ask about any specific deadlines for filing a claim. Missing deadlines can result in delays or even a denied claim.

Work with the Adjuster During the Inspection

After you submit your claim, the insurance company will send an adjuster to assess the damage. Be prepared to show them the evidence you’ve collected and ask your contractor to be present during the inspection. This ensures nothing is overlooked and that both parties are on the same page.

Common Mistakes to Avoid

Selecting a reliable roofing contractor is critical for repairing your roof and supporting your insurance claim. A good contractor will make the process smoother, while the wrong one could cause headaches.

Hire a Reputable, Certified Contractor

Choose a contractor with a solid reputation and valid certifications. You can verify their legitimacy by checking:

How Your Contractor Can Assist with the Claims Process

A skilled contractor can help document the damage, provide detailed repair estimates, and even work directly with your insurance company. They can communicate with adjusters on your behalf, ensuring that the full scope of the damage is considered in your claim. This can make the entire process more seamless and less stressful for you.

Avoiding Contractor Scams

Unfortunately, scams are common after major storms. Be wary of contractors who demand large upfront payments or offer deals that seem too good to be true. Ensure the contractor provides a detailed contract outlining the work, costs, and timeline. Never pay for the full job upfront—legitimate contractors typically ask for a deposit, with the remainder due upon completion.

Understanding the post-filing process can help you anticipate and address any issues that may arise.

The Adjuster’s Role in Approving or Denying a Claim

After the adjuster’s inspection, they’ll determine whether your claim is valid and how much the insurance company will pay. Be prepared to answer any additional questions or provide further evidence if needed.

Timeline for Receiving a Claim Settlement

After your claim is approved, you’ll receive a settlement offer. This process can take anywhere from a few weeks to a few months, depending on the complexity of the claim. Remember that insurers aim to settle claims within 30 to 60 days, but if delays occur, follow up promptly.

Read more about how long home insurance claims take to settle.

What to Do if Your Claim Is Denied

If your claim is denied, ask your insurer for a detailed explanation. You can then:

Your roof is a vital shield, protecting your home from the elements. While the insurance claim process may seem daunting, with the right knowledge and preparation, you can confidently secure the new roof your home needs—preserving its value and protecting your future. Understanding how to claim a new roof on your homeowners’ insurance is the first step to ensuring you are covered when faced with unexpected roofing issues.

Don’t wait until disaster strikes. Review your policy today to ensure you’re prepared for any potential roofing issues. When the time comes, seek professional guidance to navigate the claims process easily and protect your most valuable asset—your home.

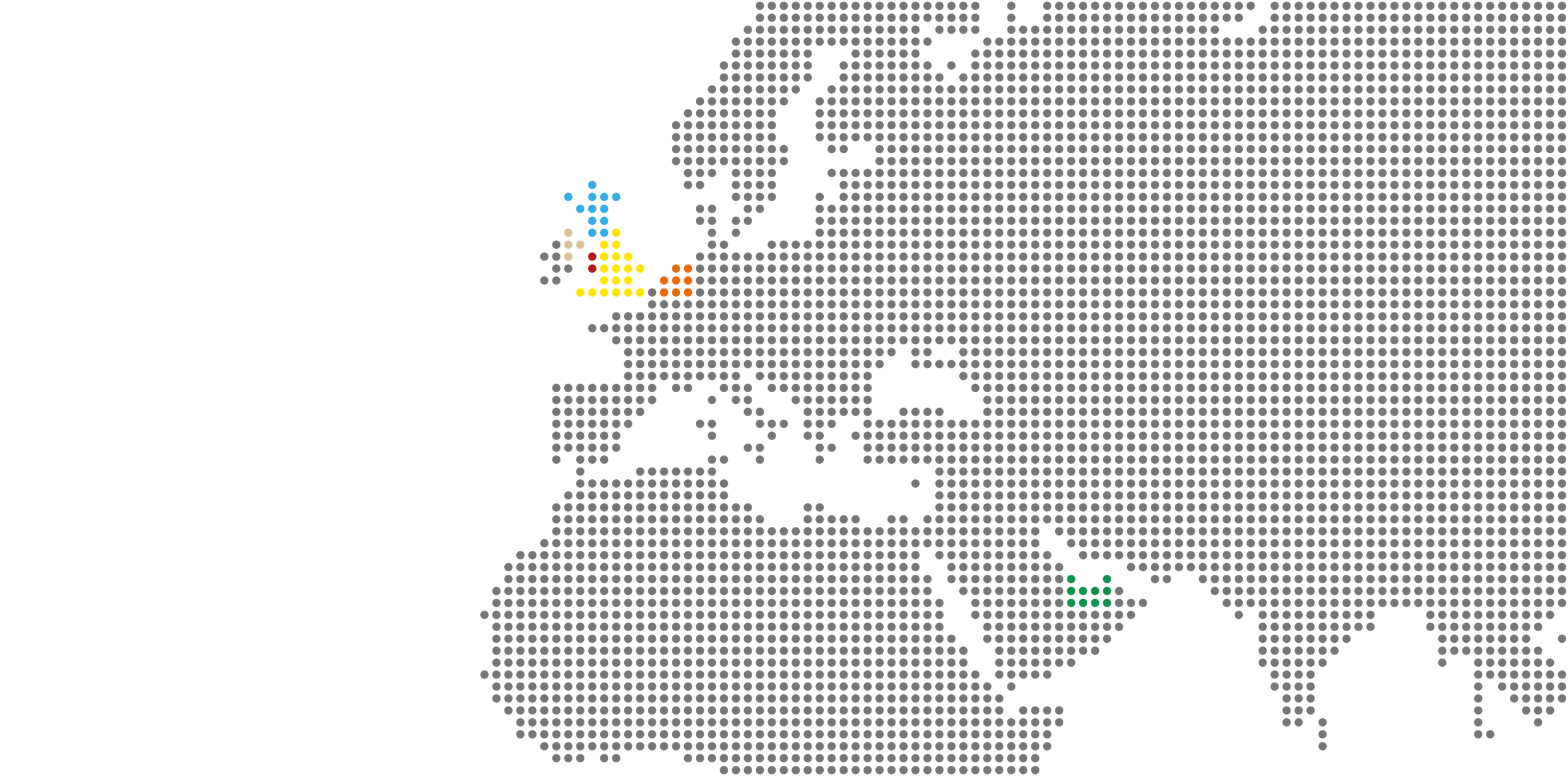

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement. With no upfront fees required, our internal data shows that insurance claims managed by professional loss assessors like Oakleafe can expect a settlement up to 40% higher than claims managed by the policyholder.

What Oakleafe Clients Say:

Please complete the form and one of our insurance claim professionals will call you back ASAP